Shares in Lululemon Athletica Inc. (LULU) dropped in extended market trading on Thursday, after the popular retailer’s quarterly results missed analysts’ expectations due to its coronanvirus-related store closures.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stock fell over 5% to $292.50 in after-market trading.

The athletic wear maker’s sales declined 17% to $652 million in the first quarter ended May 3, which is below the $688.4 million estimate by analysts. Net income sank 70.4% to $28.6 million in the quarter compared with the same period last year. Diluted earnings per share amounted to 22 cents, a cent lower than expectations. The figure compares with the 74 cents per share earned in the first quarter last year.

Still, sales from its e-commerce business soared some 68% year-on-year to $352 million and accounted for 54% of total revenue.

As a result of the COVID-19 pandemic, all of Lululemon’s stores in North America, Europe, and certain countries in Asia Pacific were closed for a significant portion of the quarter, the company said. Since May 3, stores started to gradually be reopened in line with the guidance from local authorities. As of June 10, 295 of its 489 stores globally were reopened.

Lululemon ended the first quarter with $823 million in cash and cash equivalents and a revolving credit facility of $398.2 million. Inventories increased 41% to $625.8 million year-on-year.

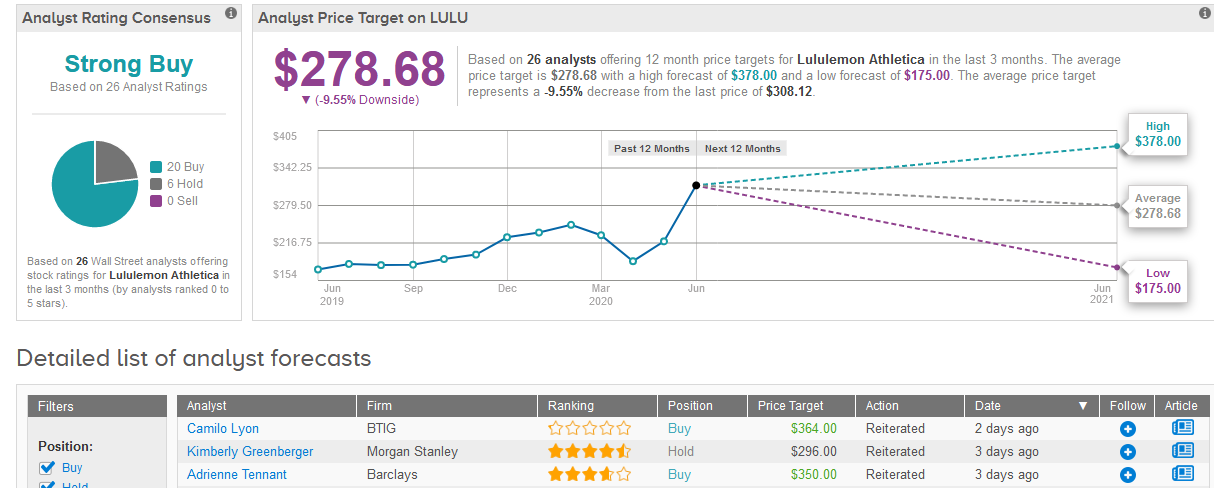

Looking past the period of store closures and coronavirus-led disruptions, the majority of analysts seem confident in Lululemon’s growth potential. Indeed, shares are currently still up 32% year-to-date, and the stock scores a bullish Strong Buy Street consensus, with 20 recent buy ratings versus 6 hold ratings.

Five-star analyst Robert Drbul at Guggenheim raised the stock’s price target to $350 from $235 and maintained a Buy rating as he believes that LULU should drive continued top-line strength in the coming years, with the brand pursuing a significant global opportunity.

“Over the next 4-5 years, once LULU moves past headwinds related to COVID-19, we believe its plans to grow revenue in the low teens with margin expansion from both GM improvement and SG&A leverage driving mid-teens operating income growth, appear achievable,” Drbul wrote in a note to investors. “LULU remains one of the strongest brands in retail, in our view, with ample runway for growth in Men’s, digital, and Int’l, while still delivering strong growth in the “core” (Women’s, stores, NA).”

Meanwhile, following the stock’s recent rally the average analyst price target stands at $278.68 (9.6% downside potential). (See LULU stock analysis on TipRanks).

Related News:

Macy’s Spikes 15% After-Hours On New Financing Deal

Syracuse Is Said To Be In Talks To Buy Bankrupt J.C. Penney; Shares Leap 55%

Buckle Down Says Street, As Stitch Fix Sinks 7% Post-Print