American electric vehicle (EV) makers witnessed a sharp decline in stock prices yesterday as a few unfavorable events developed. In particular, the newly founded companies that have their horses bet on the burgeoning EV race saw significant drops.

Lucid Group (NASDAQ:LCID) took the worst hit with an 8.03% drop in its stock price on September 22. Rivian Automotive (NASDAQ:RIVN) stock fell 5.04%. Meanwhile, Fisker (NYSE:FSR) hit a new 52-week low of $7.90 and ended the day down 3.64%.

Key Reasons for the Drop in American EV Stocks

Yesterday, the Chinese government warned against the “discriminatory” clause in the Inflation Reduction Act (IRA) of excluding tax credits to EVs assembled outside the U.S., a Bloomberg report stated.

Shu Jueting, the spokesperson of the Ministry of Commerce, said, “China will continue to assess and evaluate the implementation of the legislation and will take measures to safeguard its legal interests, when necessary.” The mainland also called the law a breach of the World Trade Organization (WTO) principles.

The law has received similar disapproval from South Korea, Japan, and European Union authorities. Last week, these nations stated that the law proved disadvantageous to their auto and battery makers. The European Commission also called the new laws “detrimental to transatlantic trade and contrary to international trade rules,” which are free from any sort of discriminatory bias.

American EV makers are poised to benefit massively from the legislation, which has designed $7,500 in tax breaks if the necessary components of their batteries, like lithium, cobalt, and nickel, are processed, recycled, or assembled in the U.S.

China, particularly, will be hurt the most as it boasts of being one of the largest producers of electric batteries, controls 92% of processed materials, 71% of cell assembly, and 65% of battery components used in EVs, the report added.

Furthermore, the Federal Reserve’s continued hawkish stance and increasing interest rates continue to demotivate consumers’ purchasing power. Also, EV makers worldwide are already battling persistent supply chain issues and elevated costs of input materials, forcing them to increase the prices of EVs.

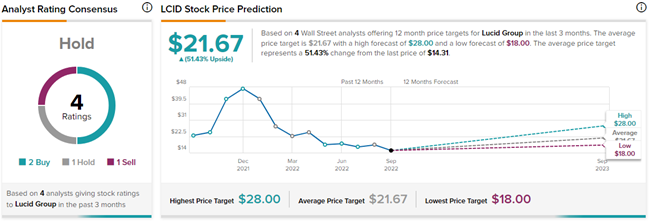

What is the Prediction for Lucid Stock?

On TipRanks, LCID stock has a Hold consensus rating. This is based on two Buys, one Hold, and one Sell. The average Lucid stock prediction of $21.67 implies an impressive 51.4% upside potential to current levels. Meanwhile, the stock has lost a whopping 65% so far this year.

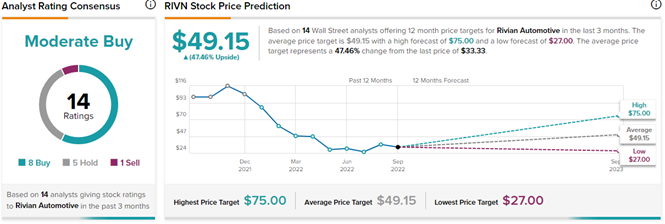

What is Rivian Stock Price Prediction?

RIVN stock has a Moderate Buy consensus rating on TipRanks. The average Rivian stock prediction of $49.15 implies 47.5% upside potential to current levels. This is based on eight Buys, five Holds, and one Sell. Meanwhile, year-to-date the stock is down 67.6%.

What is Fisker Target Price?

FSR stock has a Moderate Buy consensus rating based on five Buys, two Holds, and one Sell. On TipRanks, the average Fisker price target of $13.50 implies 69.8% upside potential to current levels. Meanwhile, FSR stock has lost 52.4% so far this year.

Final Thoughts

The U.S. government is implementing laws to focus investment and economic development on home soil. At the same time, the authorities are trying to reduce the dependence on other nations. While the IRA is one such law focused on promoting the EV sector, other nations are not very happy with its consequences. Drawing the ire of competing nations may require the U.S. government to alter the laws.

Questions or Comments about the article? Write to editor@tipranks.com