Lucid Group (NASDAQ:LCID) shares are under pressure today after the electric vehicle maker’s CFO, Sherry House, resigned from her position with immediate effect.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, Ms. House will serve in an advisory role with the company until the end of this month. While the company scouts for a new CFO, Gagan Dhingra, its Vice president of Accounting and Principal Accounting Officer, will act as Interim CFO and Principal Financial Officer.

This top-level departure from the company comes only a day after it was excluded from the Nasdaq-100 Index (NDX). Today’s price decline adds to the 44% value erosion in the company’s shares over the past year.

Recently, Lucid slashed the prices of its Air luxury sedans and introduced the Gravity SUV at the Los Angeles Auto Show. The Gravity SUV is expected to go into production in late 2024. At the same time, Lucid has lowered the production outlook for the full year to 8,000-8,500 vehicles from the prior target of 10,000. Facing stagnating EV sales and weak demand, automakers Ford (NYSE:F) and Stellantis (NYSE:STLA) have also resorted to production cuts.

What is a Good Price for LCID Stock?

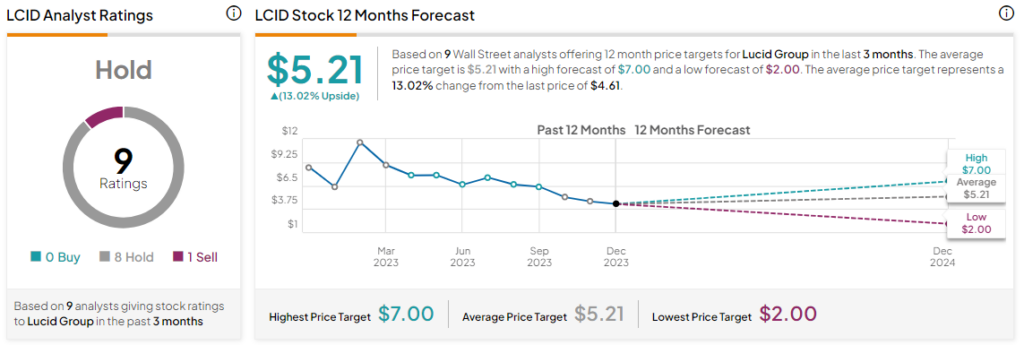

Meanwhile, the overall consensus rating for Lucid shares remains a Hold. The average LCID price target of $5.21 points to a modest 13% potential upside in the stock.

Read full Disclosure