Lowe’s shares sank 8.2% on Wednesday as the home improvement retailer delivered mixed results for the third quarter of fiscal 2020 (ended Oct. 30) and issued lower-than-anticipated guidance.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company’s 3Q adjusted EPS increased 40% year-over-year to $1.98, lagging analysts’ forecast of $1.99. Lowe’s (LOW) 3Q earnings growth was driven by higher sales but was partially impacted by supply chain costs and COVID-related expenses.

Sales grew 28.3% to $22.3 billion, with comparable sales growth of 30.1%. The company surpassed analysts’ sales estimate of $21.3 billion. Lowe’s and other home goods retailers have been gaining from increased spending on home enhancements amid the pandemic. The company experienced strong demand from its DIY (do-it-yourself) as well as pro customers. Moreover, online sales surged 106%.

Looking ahead, Lowe’s expects its 4Q overall sales and comparable sales growth to be in the range of about 15%-20%. On the conference call, the company cautioned that it expects revenue growth to moderate from 3Q levels as outperformance in seasonal categories abates in the fourth quarter.

Meanwhile, Lowe’s predicts 4Q EPS of $1.10-$1.20. The mid-point of the 4Q earnings outlook fell short of analysts’ expectation of $1.17. Pandemic-related expenses, costs related to the reset of the layout of U.S. stores and investments in supply chain expansion are expected to weigh on 4Q earnings.

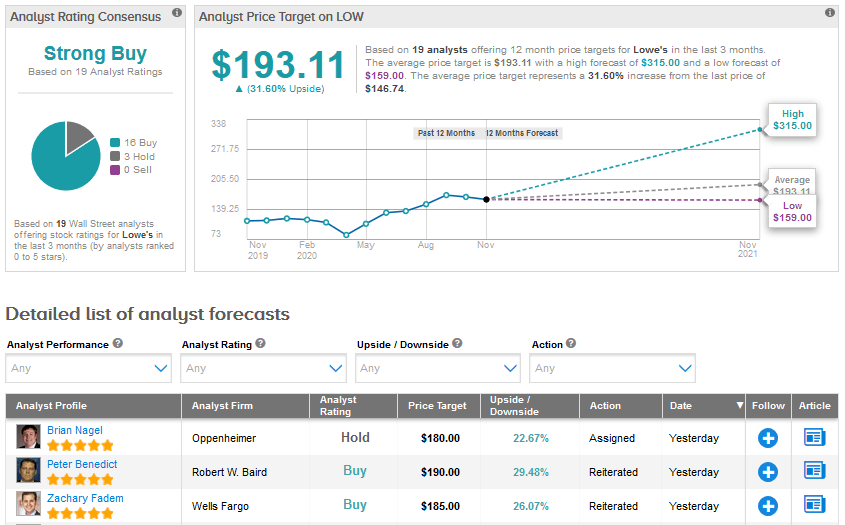

Following the print, Wells Fargo analyst Zachary Fadem reiterated a Buy rating with a $185 price target, saying, “Considering recent performance, we believe LOW is making the prudent decision to accelerate investment spending ($250M in 2H store resets; or ~60bps) from a position of strength, and with benefits from earlier initiatives (Pro, in-stocks, vendor relations, Omni, etc.) now materializing, we remain confident in LOW’s ability to drive incremental share gains and make progress towards it’s LT [long-term] EBIT margin goal of +12%.”

Fadem further commented, “While shares could prove choppy NT with the stay-at-home trade unwinding, we ultimately view today’s pullback as an attractive entry point, as LT comp/margin potential remains robust, and at 17.5x our FY21 EPS, valuation is simply too low (-5x vs. HD; -23% vs. SPX, -2.3 standard deviations below 10-year mean).” (See LOW stock analysis on TipRanks)

The Street has a bullish outlook on Lowe’s, with a Strong Buy analyst consensus that breaks down into 16 Buys and 3 Holds. LOW shares have advanced 22.5% year-to-date. The average price target stands at $193.11, implying an upside potential of 31.6%.

Related News:

Target Crushes 3Q Estimates As Online Sales Rocket 155%; Shares Rise

Home Depot’s 3Q EPS Jumps 26% On Home Improvement Boom; Street Bullish

Walmart Posts Blowout 3Q Fueled By E-Commerce Sales; Analyst Lifts PT