Lowe’s ramped up its quarterly cash dividend by 9% after the home-improvement retailer last week reported stellar earnings for the second quarter, outpacing the consensus for sales and profit expectations.

Lowe’s (LOW) announced that its Board of Directors declared a quarterly cash dividend of 60 cents per share, which takes the third quarter payout to about $455 million. The dividend, which presents a 9% hike over the previous quarterly payout, is payable on Nov. 4 to shareholders of record as of Oct. 21. The company has declared a cash dividend every quarter since going public in 1961.

“Based on our confidence in our continued, broad-based business momentum and robust cash flow generation, we are pleased to announce a nine percent increase in our dividend,” said Lowe’s CEO Marvin Ellison. “This increase reflects our commitment to delivering strong shareholder returns through our disciplined capital allocation program.”

Lowe’s reported last week that same-store sales surged 34.2% in the second quarter, blowing past analysts’ estimates for a 16.3% increase, with comparable sales for the US home improvement business rising by 35.1% from 2Q19. That was with sales for Lowes.com exploding by 135% year-over-year. On an adjusted basis, the company earned $3.75 per share, exceeding the Street consensus for a profit of $2.95.

As of July 31, 2020, Lowe’s operated 1,968 home improvement and hardware stores in the US and Canada.

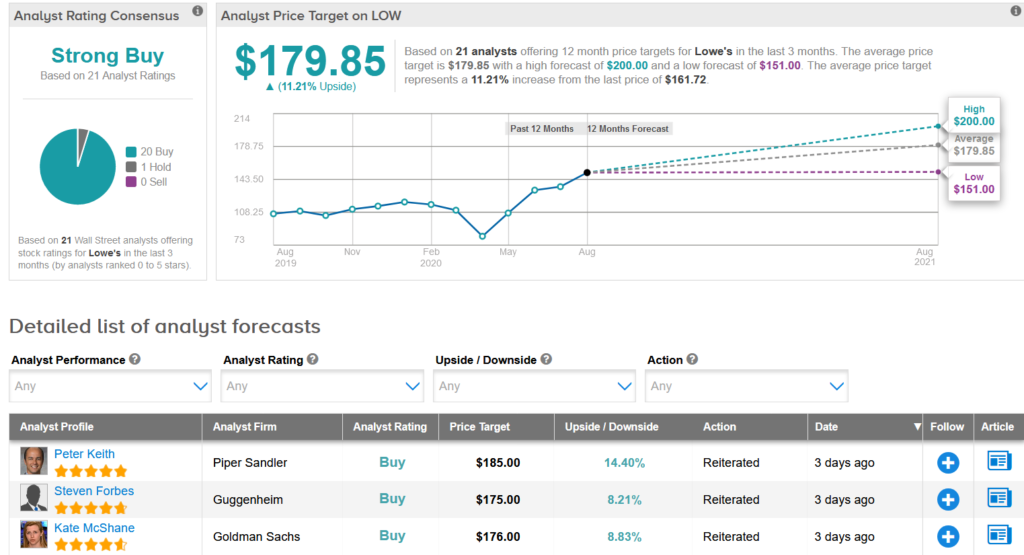

Shares in LOW appreciated 2% to $161.72 at the close on Friday, and have climbed 35% year-to-date as the increased demand for DIY products during the coronavirus pandemic played to Lowe’s advantage. (See LOW stock analysis on TipRanks)

Piper Sandler analyst Peter Keith last week increased the stock’s target to $185 from $170 and reiterated an Buy rating, saying that the company’s management signaled ongoing strength near-term and substantial opportunity long-term.

Following the company’s 2Q performance, Keith sees potential for upwards earnings revisions and expects the shares to continue to move higher.

Overall, the stock scores a bullish Strong Buy Street consensus, with 20 Buy ratings versus 1 Hold rating. What’s more, the average analyst price target of $179.85 indicates another 11% upside potential from current levels.

Related News:

Lowe’s Delivers Blowout Q2 As Online Sales Surge 135%

Walmart Delivers Earnings Triumph; E-Commerce Sales Double

Home Depot Sales Exceed Estimates As Shoppers Pile On DIY Products