Energy giant Exxon Mobil’s (NYSE:XOM) Q4 2022 earnings will be impacted by a decline in energy prices compared to the third quarter, as per an update provide by the company. Exxon will provide more details when it announces its Q4 2022 results on January 31, 2022.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Exxon’s Q4 Earnings Update

Lower natural gas prices are expected to drag down Q4 earnings by $2 billion to $2.4 billion, while the decline in crude oil prices is projected to have an impact of $1.3 billion to $1.7 billion. The company’s Q4 upstream earnings are expected to gain from mark-to-market derivative gains of $1.3 billion to $1.5 billion. Currently, analysts expect the company to post adjusted EPS of $3.30 in Q4, reflecting a 61% increase from the prior-year quarter.

Energy prices cooled down in Q4 compared to the elevated levels seen earlier in 2022 due to demand concerns owing to macro pressures and the COVID-19 resurgence in China. Nonetheless, Exxon is expected to deliver strong Q4 2022 earnings on a year-over-year basis, ending its most profitable year ever with an estimated net income of over $58 billion, as per Bloomberg projections.

Exxon’s EPS surged 207% year-over-year to $10.17 in the first nine months of 2022. The company’s robust earnings helped it in enhancing shareholder returns through dividends and buybacks.

The huge profits earned by Exxon and other energy giants invited windfall profit taxes by the U.K. and European Union (EU). Exxon recently sued the EU in an attempt to block the windfall tax. U.S. President Joe Biden also warned oil companies about windfall tax if they do not use their excess profits to boost production and bring down prices at the pump, which are hitting customers who are already burdened by high inflation. Last month, Exxon announced its capital expenditure budget, which includes billions of dollars of investment in the Permian basin.

What is the Target Price for Exxon Stock?

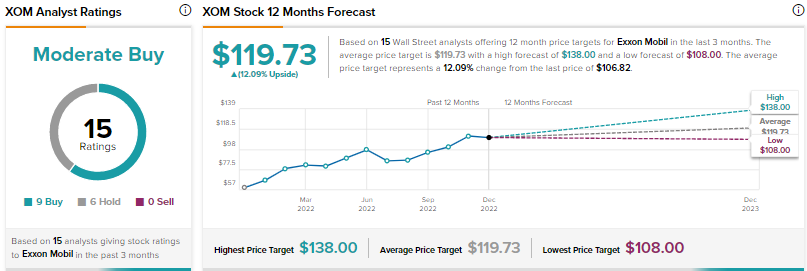

The Street’s Moderate Buy consensus rating for Exxon Mobil stock is based on nine Buys and six Holds. The average XOM stock price target of $119.73 implies 12.1% upside potential. Shares have surged over 66% over the past year. Exxon’s dividend yield stands at 3.3%.