Lowe’s (NYSE:LOW) shares are in focus today after the home improvement retailer posted better-than-anticipated numbers for the fourth quarter. Despite a year-over-year decline of 17%, revenue of $18.6 billion fared better than estimates by $130 million. In sync, EPS of 1.77 outpaced expectations by $0.09.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Furthermore, due to tepid DIY demand and adverse weather conditions in January, the company’s comparable sales declined by 6.2% during the quarter. Despite these challenges, the company is banking on its Total Home strategy to boost its market share in the home improvement market.

For Fiscal Year 2024, Lowe’s expects total sales in the range of $84 billion to $85 billion. EPS for the year is seen landing between $12 and $12.30. Additionally, the retailer expects its comparable sales to contract by 2% to 3%. The company operated a total of 1,746 stores as of February 2, 2024.

Is LOW Stock a Buy, Sell, or a Hold?

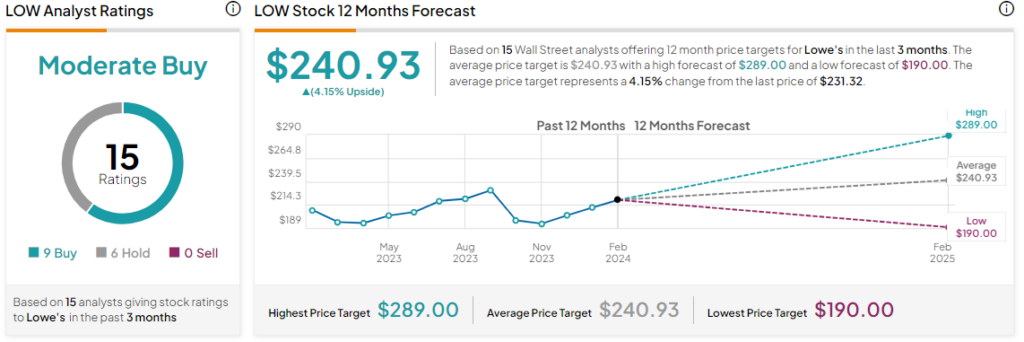

Shares of the company have rallied by nearly 16% over the past three months. Overall, the Street has a Moderate Buy consensus rating on Lowe’s, and the average LOW price target of $240.93 points to a modest 4.1% potential upside in the stock. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue