Logitech (LOGI) raised its 2021 annual profit outlook after operating income spiked 75% in the first quarter as stay-at-home orders tied to the coronavirus pandemic boosted demand for its computer products.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Logitech’s non-GAAP operating income in the quarter ended June 30 surged to $117.3 million, up from $67 million in the year-earlier period. Q1 sales increased 23% to $792 million during the same comparative period.

Following the robust results, the company raised its annual outlook for non-GAAP operating profit to the range of $410 million-$425 million from $380-$400 million. It also ramped up its sales outlook for the 2021 fiscal year to 10% to 13% growth from mid single-digit percentage growth in constant currency.

“We grew sales 25% with strong growth in almost every product category. Our company strategy focuses on four long-term trends: more of us will work from home; video calls will replace audio calls; esports will become as big as conventional sports; and billions of people worldwide will create content, not just a handful of TV and movie studios,” said Logitech CEO Bracken Darrell. “Logitech’s business was already positioned to grow from these long-term trends, and since early March they have accelerated, making Logitech more relevant to customers than ever before.”

At the end of the reported quarter, cash flow from operations was $119 million, compared to $37 million in the same period a year ago.

Shares in Logitech more than doubled since hitting a low in mid-March and are now up 50% since the start of the year.

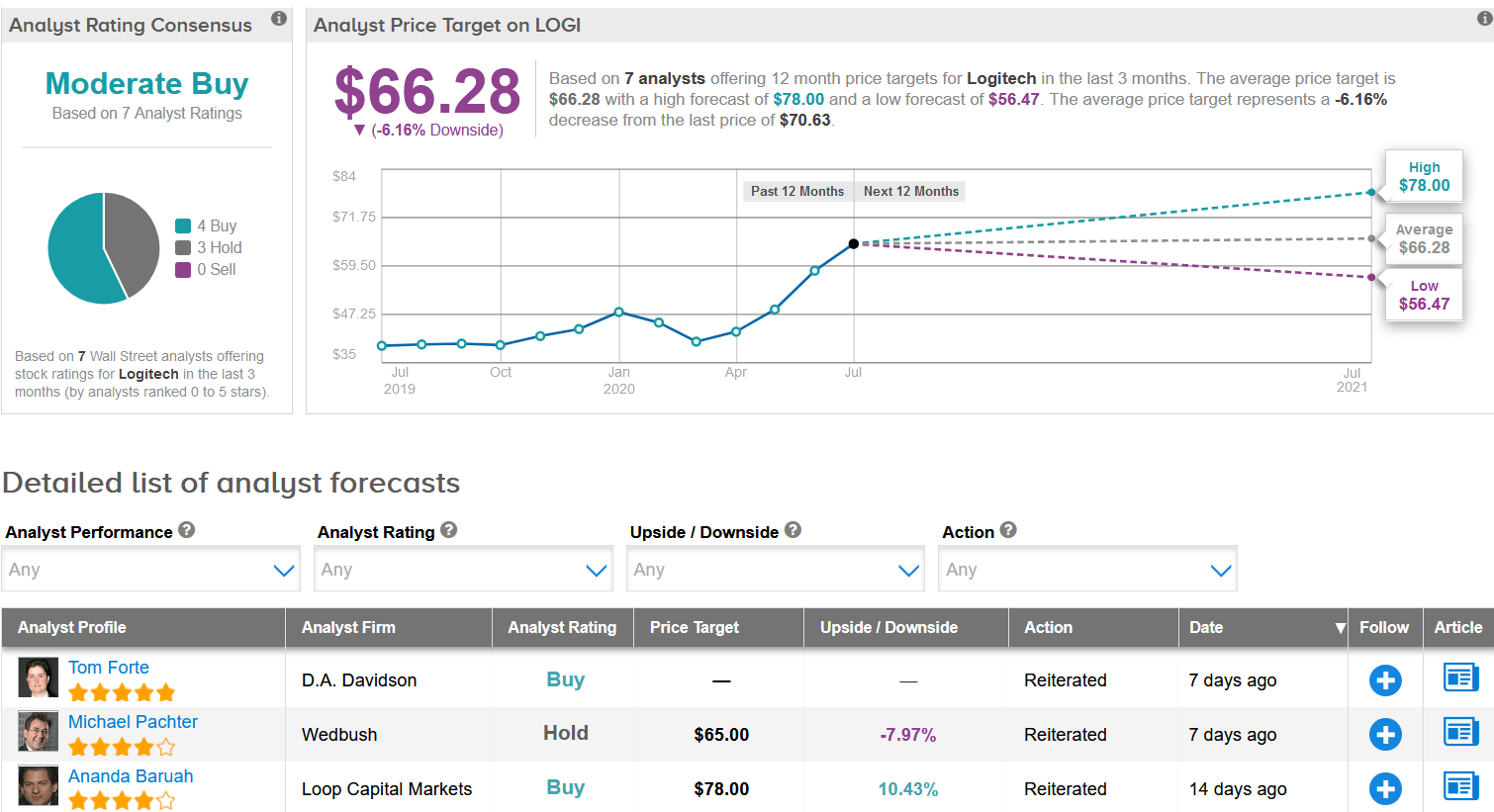

Last week, Wedbush analyst Michael Pachter reiterated a Hold rating on the stock with a $65 price target as shares were trading near his price target and as he sees limited room for multiple expansion.

“Logitech’s consistent earnings growth with investor-friendly capital allocation should support shares of LOGI near the high-end of its historical range, given the boost from quarantines and as the overhang from supply chain disruption dissipates,” Pachter wrote in a note to investors. “The company also has an excellent M&A track record and is likely on the hunt in the current environment.”

The rest of Wall Street analysts are cautiously optimistic on the stock’s outlook. The Moderate Buy consensus brings together 4 Buy versus 3 Hold ratings. The $66.28 average price target implies 6.2% downside potential in the shares in the next 12 months. (See Logitech stock analysis on TipRanks)

Related News:

Synaptics Snaps Up DisplayLink For $305M In All-Cash Deal; Top Analyst Lifts PT

IBM Pops 5% in Extended Trading After Quarterly Profit Beats Expectations

Starbucks Expands China Order Services To Four Alibaba Apps