Lockheed Martin (LMT) has won a $15 billion contract to supply the U.S. Air Force with its C-130J Hercules transport aircraft.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The contract was awarded for the development, integration and production of all the four variants of the military transport aircraft. The U.S. Air Force said that the contract is for an indefinite quantity and indefinite delivery. Work, which will be performed at Lockheed’s plant in Georgia, is expected to be completed July 16, 2030.

The C-130J aircraft can carry tons of supplies more than 3,000 miles and deliver “the last mile” to remote operating bases, keeping trucks off dangerous highways. It operates with only two pilots and one loadmaster for most missions, exposing fewer flight crew members to potential combat threats. The aircraft is used by about 20 countries around the globe.

“This contract involves foreign military sales and is the result of a sole-source acquisition” the U.S. Air Force said in a statement. “Fiscal 2018 and 2019 aircraft procurement funds in the amount of $3,300,000 are being obligated at the time of award.”

Separately, Lockheed was awarded a $935 million contract by the U.S. Navy to procure support equipment, autonomic logistics information system hardware, training systems, site activations and integrated contractor support for its F-35 Lightning II.

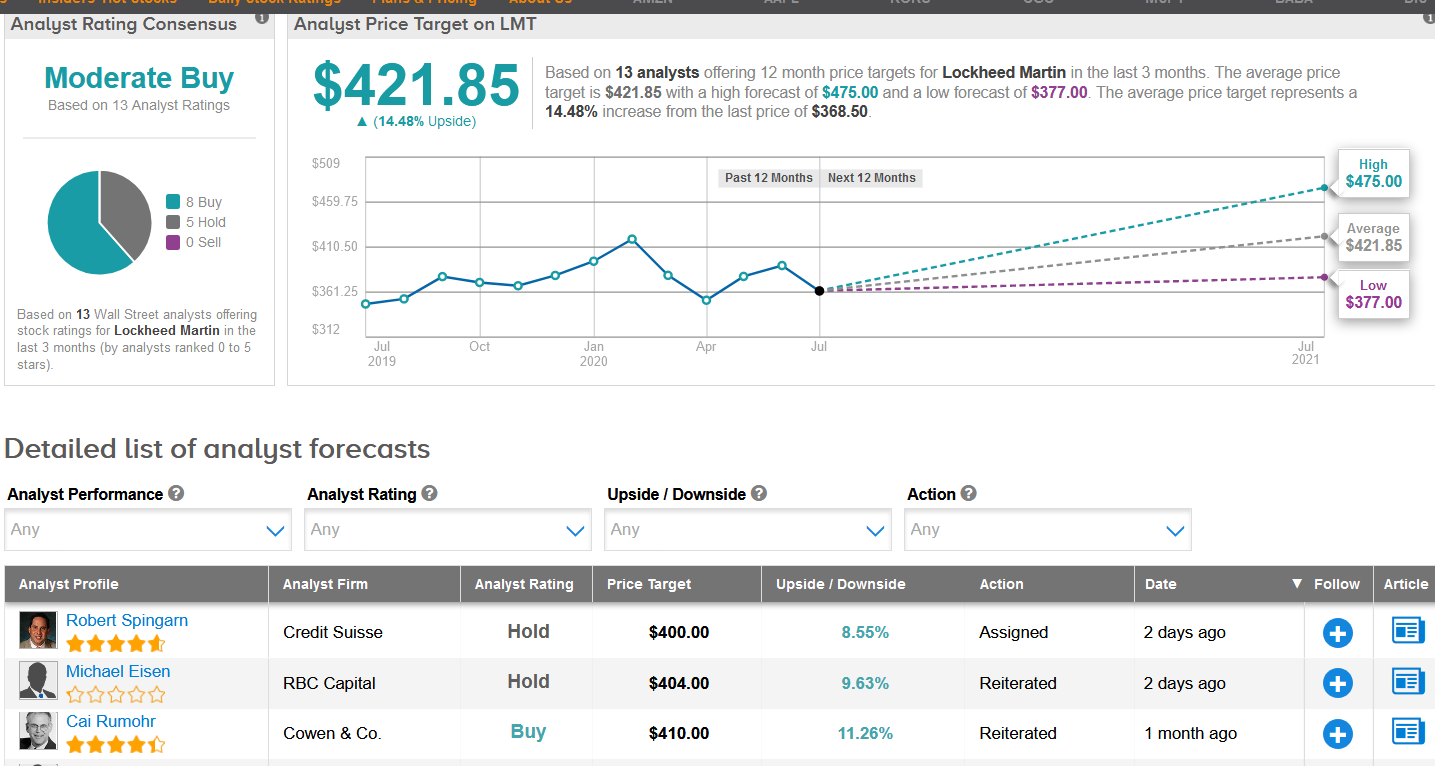

Ahead of the company’s Q2 financial results on July 21, Credit Suisse analyst Robert Spingarn cut the stock’s price target to $400 (8.9% upside potential) from $433 and maintained a Hold rating, amid expectations that the Covid-19 impact will put pressure on its aeronautics business.

The analyst forecasts Q2 EPS of $5.76, down from $5.87 previously, noting that Covid-19 cases have been rising both across the country and in areas where Lockheed has key manufacturing operations, including Fort Worth, creating some risk to near-term numbers from a supply-side perspective.

Overall, LMT scores a Moderate Buy rating from the Street with 8 recent Buy ratings versus 5 Hold ratings. Meanwhile, with shares down 5.4% year-to-date, the $421.85 average analyst price target translates into about 15% upside potential from current levels. (See Lockheed’s stock analysis on TipRanks).

Related News:

American Airlines, JetBlue Partner To Boost Flight Options In Bid For Covid-19 Recovery

Delta Posts $2.8B Quarterly Loss, Cuts Summer Flights Amid Rise In Covid-19 Cases

Airbus First-Half Deliveries Drop 49% Amid Covid-19 Aviation Crisis