Lockheed Martin (NYSE: LMT) revealed that it has terminated its agreement to acquire Aerojet Rocketdyne Holdings, Inc. after facing a regulatory hurdle in January 2022. The $4.4 billion deal was announced in December 2020.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Lockheed is an American aerospace, arms, defense, information security, and technology corporation with worldwide interests.

The move comes following a U.S. Federal Trade Commission (FTC) lawsuit, seeking a preliminary injunction to block the acquisition. The regulator believed that the deal will likely allow Lockheed to control the critical propulsion inputs supplied by Aerojet, by denying, limiting, or otherwise disadvantaging competitors’ access to inputs for various weapon systems.

Lockheed said that the acquisition would have benefitted the defence industry through greater efficiency, speed, and significant cost reductions for the U.S. government.

The Chairman, President and CEO of Lockheed, James Taiclet, said, “Moving forward, we will maintain our focus on the most effective use of capital with the highest return on investment, including our ongoing commitment to return value to shareholders. We remain confident in our company’s strong foundation and growth potential as several exciting projects enter production.”

Dividend History

Lockheed’s dividend history seems decent. LMT has been increasing its quarterly dividend once each year with the recent hike been declared in September 2021. The company has raised its quarterly common stock dividend to $2.8, up 7.7%.

News Sentiment

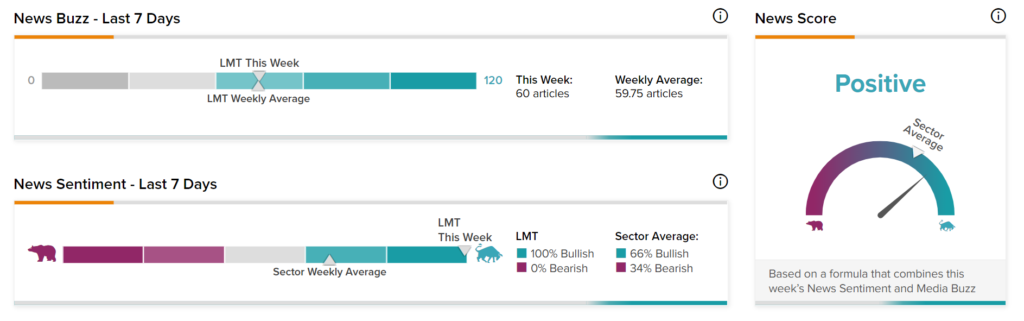

News Sentiment for Lockheed is Positive based on 60 articles over the past seven days. All the articles have Bullish sentiment, compared to a sector average of 66%, and none have Bearish Sentiment, compared to a sector average of 34%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

fuboTV Secures Market Access Deal in Three More States

Zillow Posts Q4 Revenues Beat and Upbeat Outlook; Shares Pop 13%

XPeng Boosts Presence in Europe with Partnerships and Retail Store Openings