Eli Lilly’s (LLY) second-quarter 2024 financial results are in, and they are nothing short of impressive. The pharmaceutical giant saw a staggering 36% increase in revenue compared to the same quarter last year, thanks largely to its key drugs: Mounjaro, Zepbound, and Verzenio. If you exclude the $579 million from the sale of Baqsimi rights last year, Lilly’s revenue actually shot up by 46% this quarter. Quite a leap, right? The company didn’t just stop at impressive revenue growth; it also raised its full-year revenue guidance by $3 billion, reflecting a bullish outlook for the remainder of the year.

LLY’s Driving Factors: Mounjaro, Zepbound, and Verzenio

The standout performers in Lilly’s portfolio were Mounjaro, Zepbound, and Verzenio. Mounjaro’s revenue skyrocketed to $3.09 billion from $979.7 million in Q2 2023, driven by high demand and favorable channel dynamics. Zepbound, launched in the U.S. for obesity treatment, generated $1.24 billion in revenue, reflecting its swift uptake. Verzenio, a drug for cancer treatment, saw its revenue increase by 44% to $1.33 billion, supported by heightened demand.

Lilly’s total revenue in the U.S. surged to $7.84 billion, a 42% increase, thanks to a 27% rise in volume and a 15% boost from higher realized prices. This growth was led by Mounjaro, Zepbound, and Verzenio, although Trulicity saw a decline, partly due to competitive pressures and supply constraints.

LLY’s Financial Breakdown

Gross margin for Q2 2024 was $9.13 billion, up 40% from last year, with a gross margin percentage of 80.8%. This increase was largely due to a favorable product mix and higher realized prices. However, production costs did rise, contributing to higher expenses.

Research and development (R&D) expenses grew by 15% to $2.71 billion, reflecting Lilly’s ongoing investment in its drug pipeline. Marketing, selling, and administrative expenses increased by 10% to $2.12 billion as the company ramped up its efforts to support new product launches and expand its workforce.

Furthermore, earnings per share (EPS) showed a stellar increase, with reported EPS climbing 68% to $3.28, surpassing analysts’ consensus estimate of $2.75.

Eli Lily Targets New Frontiers

But there’s more to Lilly’s story than just impressive revenue figures. The company made significant strides in its drug pipeline and strategic plans. This quarter, Lilly secured FDA approval for Kisunla, a new treatment for Alzheimer’s disease, a landmark achievement for both the company and the field. David A. Ricks, Lilly’s CEO, put it as a “moment that was decades in the making.”

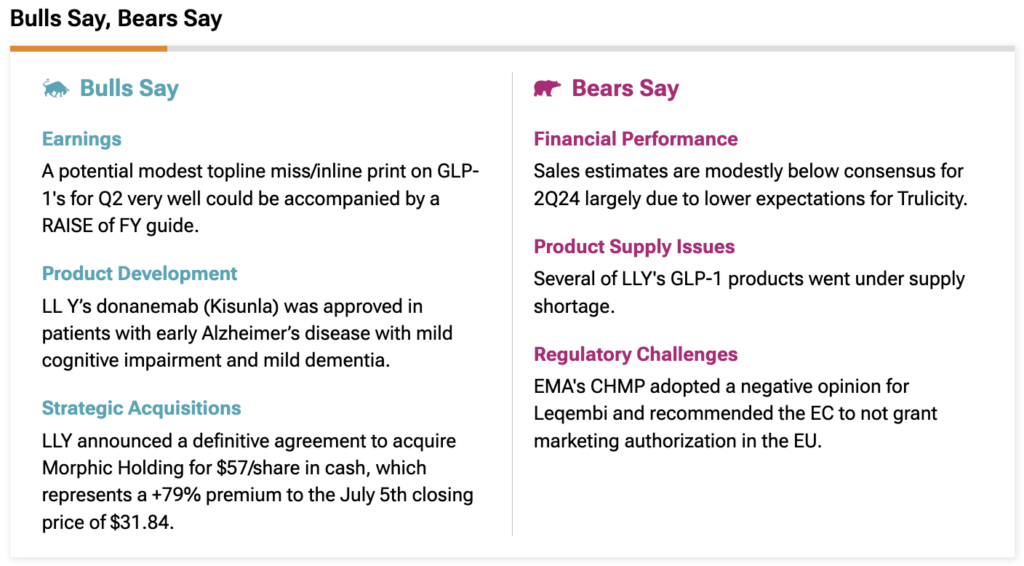

Moreover, Lilly is not resting on its laurels. The company has submitted tirzepatide for treatment of obstructive sleep apnea and is expanding its pipeline with new trials and submissions. The company also announced plans to acquire Morphic Holding, aiming to enhance its immunology pipeline with novel oral therapies for chronic diseases.

In fact, as highlighted by TipRanks’ Bull Say Bears Say, “LLY announced a definitive agreement to acquire Morphic Holding for $57 per share in cash, representing a 79% premium over the closing price of $31.84 on July 5.” This premium adds a strong point in favor of LLY stock.

Eli Lily’s Forward Guidance

Looking ahead, Lilly has raised its 2024 revenue guidance to a range of $45.4 billion to $46.6 billion. This optimistic forecast reflects strong performance from Mounjaro and Zepbound, along with improved clarity on production expansions and international launches. The company also adjusted its EPS guidance, now projected to be between $15.10 to $15.60 on a reported basis and $16.10 to $16.60 on a non-GAAP basis.

Is LLY a Good Stock to Buy Now?

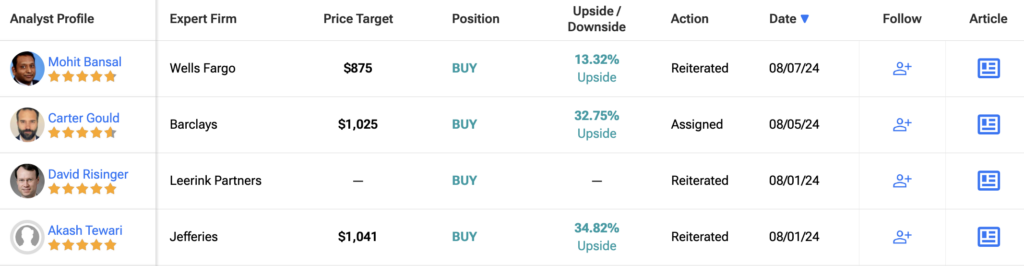

Analysts remain bullish about LLY stock, with a Strong Buy consensus rating based on 15 Buys and three Holds. Over the past year, LLY has increased by more than 49%, and the average LLY price target of $955.67 implies an upside potential of 23.8% from current levels. These analyst ratings are likely to change following LLY’s results today.