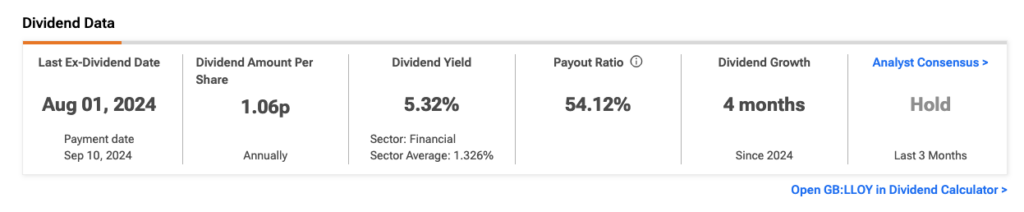

Shares of the FTSE 100-listed Lloyds Banking Group PLC (GB:LLOY) shine among income investors, thanks to the more than 5% dividend yield. As one of the UK’s oldest banks, Lloyds’ shares are a popular choice for investors, primarily due to their attractive and stable dividend payouts. Precisely, LLOY stock offers a dividend yield of 5.32%, surpassing the industry average of 1.32%. Analysts, however, have given LLOY stock a Hold rating, with a projected upside of 19.16%.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

TipRanks Makes Dividend Tracking Easier

TipRanks offers a variety of tools to help users identify dividend stocks that match their criteria, making the monitoring process easier. For instance, the TipRanks Best Dividend Stocks – UK compiles a detailed list of top dividend-paying companies in the UK, along with key comparison parameters.

Additionally, TipRanks provides a Dividend Calendar that simplifies the task of identifying and selecting stocks with upcoming dividend payment dates. This provides investors the opportunity to acquire shares and qualify for upcoming dividend payments.

Lloyds’ Dividend History

Lloyds paid a total dividend of 2.76p per share for 2023, reflecting a 15% increase from the previous year’s dividend of 2.4p per share. For 2024, the bank declared an interim dividend of 1.06p per share in September, also marking a 15% rise compared to the prior year’s interim dividend.

The dividend growth is in line with the bank’s progressive and sustainable dividend policy. Moving forward, Lloyds will continue to uphold this policy while maintaining flexibility to consider excess capital distributions for 2024.

Analysts Remain Cautious on LLOY After Q3 Results

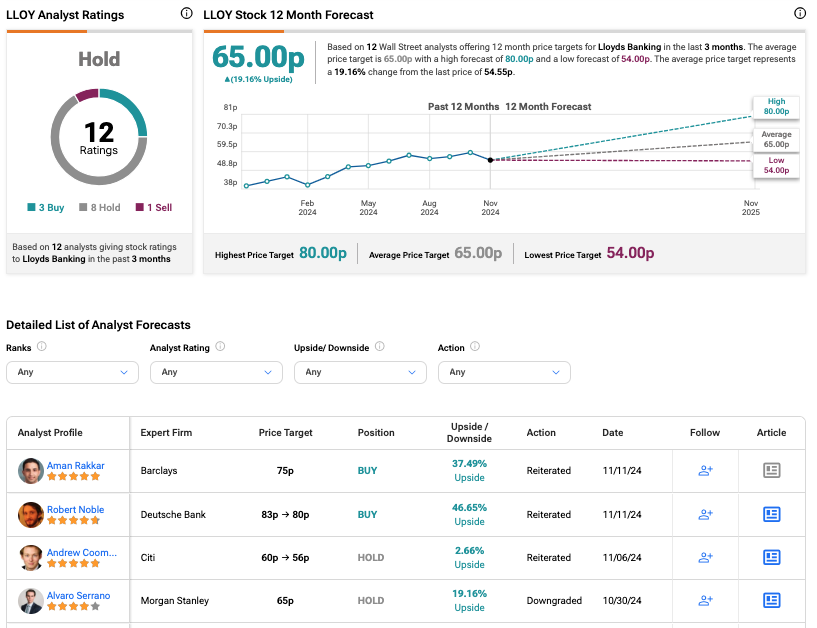

After Lloyds released its Q3 results last month, multiple analysts reaffirmed their ratings. Since then, the stock has received 10 ratings, with seven of them being Hold.

In Q3, Lloyds reported a statutory pretax profit of £1.8 billion, exceeding the analyst forecast of £1.6 billion. However, the bank’s net interest margin (NIM) fell to 2.94% from 3.15% in the previous year. Looking ahead, Lloyds maintained its performance guidance for 2024. The bank expects its NIM to stay above 2.90% for the full year.

Overall, analysts believe that with the NIM appearing to have peaked, the bank may face challenges in achieving substantial earnings growth.

Are Lloyds Shares a Good Buy Now?

According to TipRanks’ analyst consensus, LLOY stock has received a Hold rating based on a total of 12 recommendations, of which only three are Buy. The Lloyds share price prediction is 65p, which shows 19.16% upside potential in the share price.