California-based contact center platform LiveVox Holding’s (LVOX) financial results for the second quarter of 2021 have missed analysts’ expectations. The company’s platform powers over 14 billion interactions annually, along with integrating WFO capabilities, CRM and omnichannel communications.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

LiveVox reported a loss of $1.08 per share, larger than the year-ago loss of $0.05 per share and the Street’s estimate of a loss of $0.04 per share.

Total revenue increased 28.5% year-over-year to $28.9 million but fell slightly short of analysts’ expectations of $29.32 million. Contract revenue was up 34.4% at $22.4 million.

The CEO of LiveVox, Louis Summe, said, “We are also optimistic about the rapid acceleration of our channel partner opportunity pipeline and sales and believe this will be an important piece of our business going forward. We have expanded our internal sales and marketing investment by more than 35% over the same period last year and as we continue to invest heavily in our industry-leading platform, we have great confidence in our business and long-term prospects.”

For the third quarter, the company expects total revenue to be in the range of $29 million to $30 million, contract revenue to lie between $22.5 million and $23 million, and excess usage revenue to range from $6.5 million to $7 million.

For full-year 2021, LiveVox has provided a total revenue guidance range of $117 million to $119 million. It expects contract revenue to lie between $89.5 million and $90.5 million and excess usage revenue to be in the range of $27.5 million to $28.5 million.

Furthermore, the company expects contract revenue to increase by at least 25% year-over-year in full-year 2022. LiveVox’s shares closed 2.3% higher on Thursday. (See LiveVox stock chart on TipRanks)

Last month, Piper Sandler analyst James Fish initiated coverage on the stock with a Buy rating and a price target of $12 (83.2% upside potential). In a research note to investors, the analyst said, “As a cloud contact center platform, LiveVox will be a major beneficiary of the on-premise to cloud-based contact center software conversion that continues to accelerate post-COVID.”

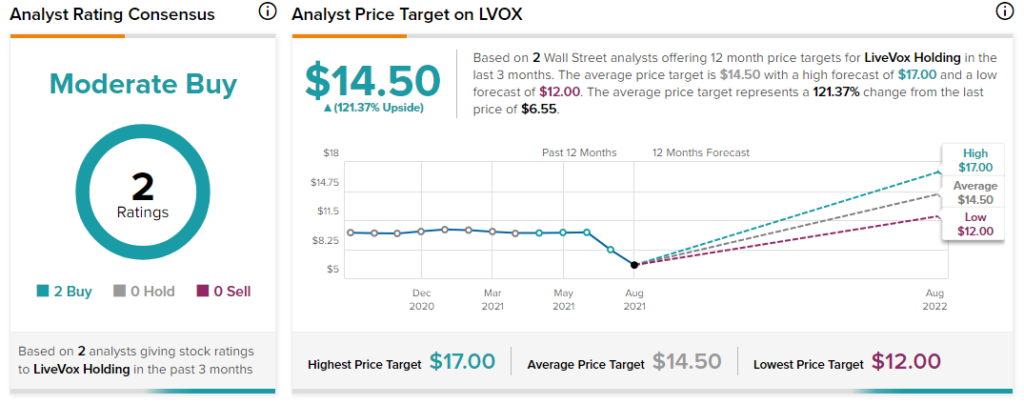

Overall, the stock has a Moderate Buy consensus based on 2 Buys. The average LiveVox Holding price target of $14.50 implies 121.4% upside potential. Shares of the company have lost nearly 38% year-to-date.

Related News:

Baidu Q2 Results Beat Estimates, Issues Q3 Guidance

Airbnb Falls on Delta Warning Despite Reporting 300% Q2 Revenue Growth

DoorDash Reports Mixed Q2 Results; Shares Fall 5.2%