Shares of audio streaming service LiveOne (LVO) surged about 24% on Monday. The upside was driven by a significant increase in its subscriber base fueled by its partnership with the EV giant Tesla (TSLA). The company reported adding nearly 100,000 new subscribers in the past two weeks, bringing its total subscriber count to about 450,000.

It is worth mentioning that subscriber growth comes even after Tesla ended free premium music streaming for many of its owners, requiring them to buy a subscription for LiveOne or switch to the ad-supported tier.

Investors should note that LiveOne and Tesla had initially joined hands in June 2022. This agreement allowed TSLA to integrate LiveOne’s streaming services into their vehicles. Later in October 2024, the companies renewed their partnership. Under the new deal, Tesla replaced its streaming button with LiveOne’s, while LiveOne pledged to provide all Tesla customers with discounted music packages.

LiveOne CEO Sees Potential in B2B Deals

This growth reflects the success of LiveOne’s strategic focus on business-to-business (B2B) partnerships. CEO Robert Ellin noted that the Tesla deal is a prime example of how such collaborations can drive user engagement, retention, and loyalty.

Importantly, Ellin hinted at more such partnerships to be announced in 2025. With these deals, LiveOne would gain access to a larger user base and solidify its position in the music streaming market.

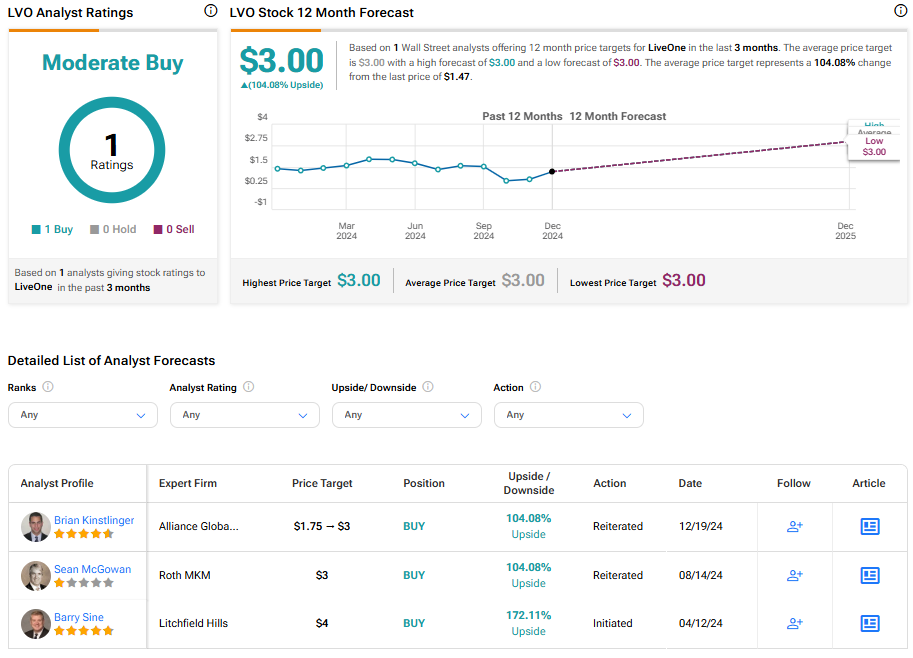

Is LVO a Good Stock to Buy?

On December 19, LVO stock received a Buy rating from a Top-rated analyst, Brian Kinstlinger from Alliance Global Partners. He raised the stock’s price target to $3 (implying 104.1% upside potential) from $1.75. Shares of the company have gained over 101% in the past three months.

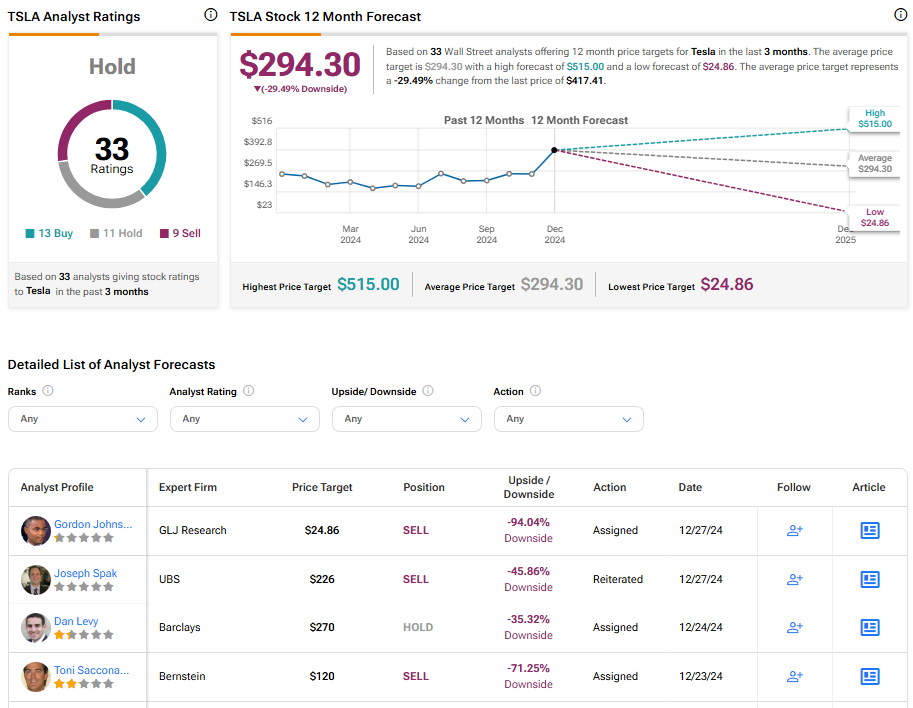

What Is the Prediction for Tesla Stock?

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 13 Buys, 11 Holds, and nine Sells assigned in the last three months. At $294.30, the average Tesla price target implies a 29.5% downside potential. Shares of the company have gained 61.8% in the past three months.