Live Nation shares (NYSE:LYV) are up over 3% at the time of writing after news that the U.S. Justice Department’s antitrust lawsuit against the company won’t go to trial until 2026. U.S. District Judge Arun Subramanian described the timeline as “appropriate” during the first trial hearing in New York, as reported by Reuters. The stock might also be benefiting from increased chances of a Donald Trump victory after the Thursday night presidential debate.

The DOJ and over two dozen states recently filed an antitrust suit against Live Nation with the aim of dismantling the company. Investors might view a potential Trump presidency as more favorable for antitrust issues than the stricter Biden administration.

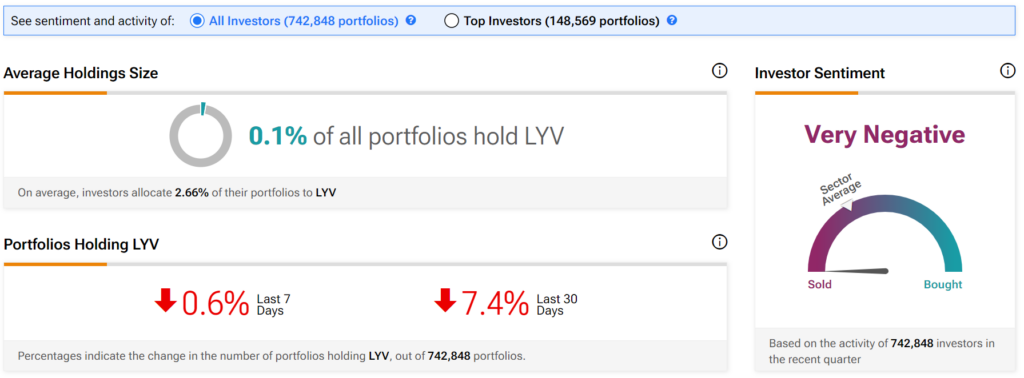

Investor Sentiment for LYV Stock

The sentiment among TipRanks investors is currently very negative, as Live Nation shares have declined roughly 10% during the past three months. Out of the 742,848 portfolios tracked by TipRanks, 0.1% hold LYV stock. In addition, the average portfolio weighting allocated towards LYV among those who do have a position is 2.66%. This suggests that investors of the company are not super confident about its future.

Furthermore, in the last 30 days, 7.4% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

Is Live Nation Entertainment Stock a Buy?

Turning to Wall Street, LYV stock has a Strong Buy consensus rating based on 16 Buys, one Hold, and zero Sell ratings. The average LYV stock price target is $118.71, implying 33.7% upside potential.