Linde Plc announced a stock repurchase program of up to $5 billion, as its its current $6 billion stock buyback plan expires on Feb. 1, 2021. Additionally, the multinational chemicals company raised its quarterly dividend.

Linde (LIN) said that under the $5 billion buyback program, the company may repurchase up to 15% of its currently outstanding shares in the period starting from Feb. 1, 2021, through July 31, 2023. The company said, “The purpose of the program shall be to reduce the share capital or to meet obligations under Linde plc equity awards.”

The company has also lifted its quarterly cash dividend by 10% to $1.06 per share, which will be paid on Mar. 22 to stockholders of record as of Mar. 5. The new dividend implies an annual dividend of $4.20 per share and reflects a dividend yield of 1.66%.

Linde’s CEO Steve Angel said, “As an integral part of Linde’s capital allocation policy, the company is committed to increasing its dividends annually.” (See LIN stock analysis on TipRanks)

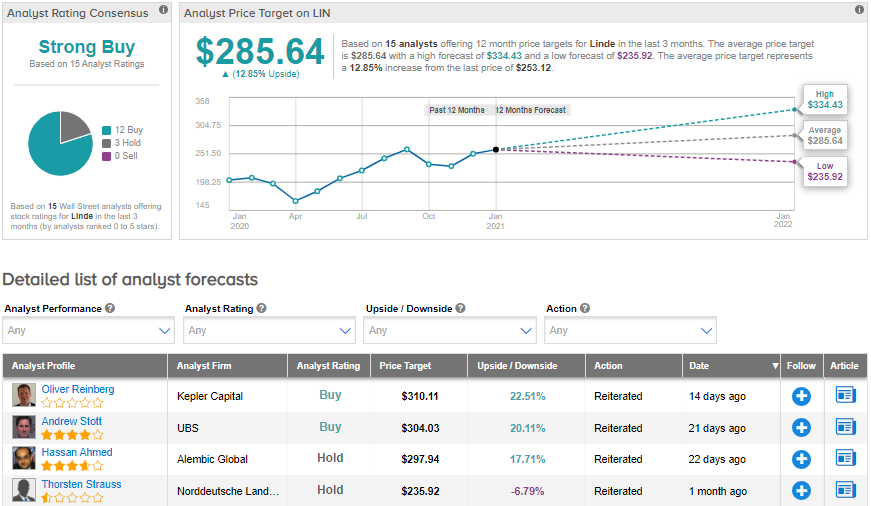

Earlier on Dec. 7, Barclays analyst Duffy Fischer upgraded Linde to Buy from Hold and raised the price target to $285 (12.6% upside potential) from $275. In a note to investors, the analyst said that the company’s EBITDA has improved in each quarter of 2020, and it “can do even better.”

Overall, the rest of the Street has a bullish outlook on the stock, with a Strong Buy analyst consensus based on 12 Buys and 3 Holds. The average analyst price target of $285.64 implies upside potential of about 12.9% to current levels. Shares have gained about 22.6% over the past year.

Related News:

Discover Financial Services To Buy Back $1.1B In Stock

Bristol-Myers To Buy Back Another $2B In Stock

Ally Financial To Buy Back $1.6B In Stock