Shares of Lightning eMotors, Inc. (ZEV) were down 14.3% in Monday’s extended trading session after the provider of commercial electric vehicles for fleets reported mixed Q2 results and pulled back its guidance for FY2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company reported a loss of $0.79 per share, which was significantly above analysts’ expectations of a loss of $0.14 per share. The company reported a loss of $0.10 per share in the prior-year period.

However, revenues jumped 580% year-over-year to $5.9 million and exceeded consensus estimates of $5.34 million. The increase in revenues reflected a 300% surge in sales of zero-emission vehicles and powertrain systems. Despite numerous supply chain constraints, the company successfully sold 37 vehicles and powertrain systems during the quarter.

Last week, the company entered into a strategic partnership with Berkshire Hathaway’s Forest River to deploy 7,500 zero-emission vehicles and related infrastructure products and services worth $850 million. (See Lightning eMotors stock charts on TipRanks)

Lightning eMotors Removes FY2021 Outlook, Provides Guidance for Q3

Based on unforeseen chassis production disruptions and COVID-19-induced delays, the company does not expect to meet its previously provided full-year targets. As a result, the company withdrew its guidance for FY2021.

However, the company has provided guidance for the third quarter of 2021. Revenues are forecast to be in the range of $4 – $6 million, while an adjusted loss from operations is expected to range between $12 million and $13 million.

Lightning eMotors CEO Tim Reeser commented, “Notably, we are in the final stages of negotiations and technical integration and validation with one of the largest worldwide battery suppliers, which we believe will mitigate our supply constraints in 2022.”

Reeser further highlighted, “While we are seeing orders being pushed to 2022 due to unexpected chassis production disruptions and COVID-related delays, none of those orders have been cancelled. Further we are taking decisive action to help address the supply chain issues which we believe will allow us to fulfill customer demand and drive substantial vehicle sales and revenue growth in the years ahead.”

Following Lightning eMotors’ deal with Forest River, Benchmark Co. analyst Michael Ward reiterated a Buy rating on the stock and a price target of $17 (76.5% upside potential).

Ward believes that the $850 million deal doubles the company’s order backlog.

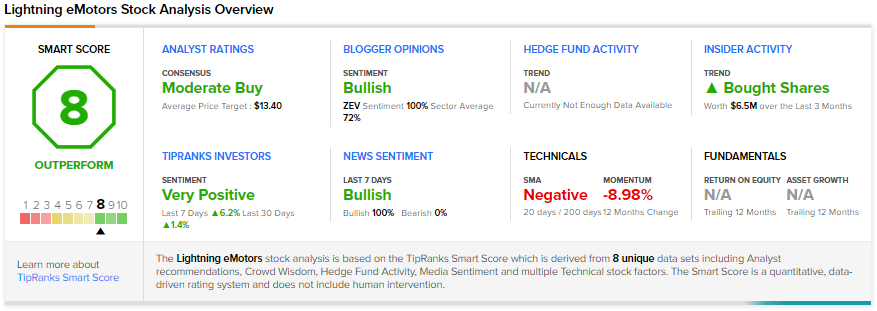

Consensus among analysts is a Moderate Buy based on 5 Buys and 1 Sell. The average Lightning eMotors price target of $13.40 implies 39.2% upside potential to current levels.

ZEV scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Forma Therapeutics Holdings Shares Fall 4.5% on Q2 Miss

HSBC Holdings to Snap up Axa Singapore for $575 million – Report

Badger Meter Bumps up Quarterly Dividend by 11%