Shares of LifeMD, Inc. (NASDAQ: LFMD) rose 8.8% on Friday after it posted an adjusted loss of $0.25 per share for the first quarter of 2022 versus the consensus loss estimate of $0.29 per share. The reported figure also compares favorably with a loss of $0.36 per share witnessed in the same quarter last year.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Results in Detail

Revenues of the direct-to-patient telehealth company grew 60% year-over-year to $29 million. About 91% of the company’s revenues were generated by subscriptions, compared with 88% in the same quarter last year.

Segment-wise, Telehealth revenues rose 70% year-over-year to $22.6 million in the first quarter of 2022. Total orders received stood at 256,651, up 59% year-over-year, and active subscribers climbed 80% year-over-year.

While WorkSimpli witnessed year-over-year revenue growth of 31% to $6.4 million, its active subscribers increased 29% to 105,050.

The CEO of LifeMD, Justin Schreiber, said, “Looking ahead we remain focused on continuing to scale our existing telehealth offerings, integrating and scaling our new telehealth businesses and delivering upon our commitment to reach Adjusted EBITDA profitability by the fourth quarter of 2022.”

Guidance

For full-year 2022, LifeMD expects revenue to be in the range of $132 million to $138 million. Meanwhile, revenues for the second quarter of 2022 are projected to be between $31 million and $33 million.

Analyst’s Take

Following the results, BTIG analyst David Larsen maintained a Buy rating on LifeMD with a price target of $8, reflecting 279.2% upside potential from current level.

Larsen said, “We do expect sales from Nava and the virtual primary care business to continue to grow, and we also believe that the broader stock-market may see some rebound in the 2H:22. As we emerge from COVID, and the market returns to work, we believe that disposable income, and demand for health and wellness solutions will increase steadily. As LFMD adds capabilities and product lines, the in-sell and cross-sell opportunities should expand and increase.”

Overall, the Street has a bullish outlook on the stock with a Strong Buy consensus rating based on three unanimous Buys. LifeMD’s average price forecast of $12.67 implies upside potential of 500.5% from current levels.

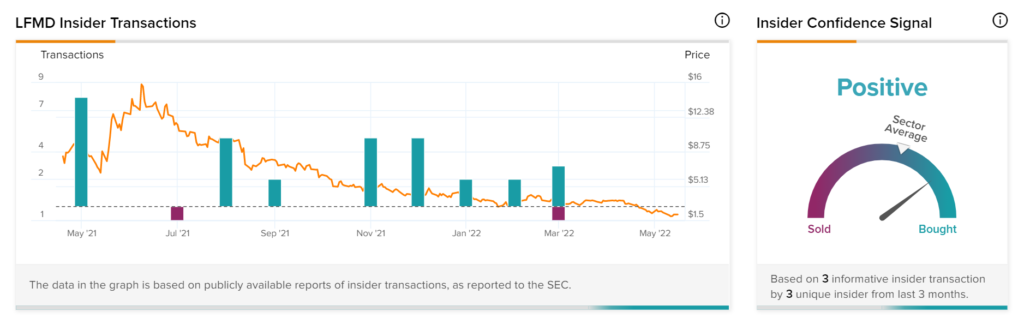

Insider Trading

Based on the recent corporate insider activity, sentiments seem to be Positive on LifeMD. This means that over the past quarter there has been an increase in insiders buying shares of LFMD.

Conclusion

The company has performed decently during the quarter. Further, its involvement in inorganic growth activities looks encouraging. However, the overall challenging operating environment remains a key challenge for the company.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Bristol Myers to Hive off New York Manufacturing Unit

Why is Payoneer Stock Rising in Pre-Market Session?

Compass Gains 7.2% Despite Mixed Q1 Results