Mass media company Liberty Media is a hot topic today after it named Derek Chang as its next president and CEO. Chang will start his new role on Feb. 1, 2025, and has been a Liberty Media Board of Directors member since March 2021. His new position will also see him added to the company’s Executive Committee of Board alongside Chairman John Malone, Vice Chairman Dob Bennett, and Chase Carey.

Chang brings an extensive history of leading media companies and sports teams to Liberty Media. That includes heading operating, corporate development, and investment teams at EverPass Media, the NBA, DirecTV, E.W. Scripps (SSP), Charter Communications (CHTR), and TCI Communications.

Chang is taking over as the next CEO of Liberty Media following the departure of former CEO Greg Maffei. Maffei left the company at the end of 2024 after announcing his planned departure earlier that year. Malone will continue to serve as interim CEO until Chang takes over in February.

What This Means for Liberty Media

Chang’s long history in sports and media will likely benefit Liberty Media. The company operates through several segments that each trade publicly. One is Liberty Media Liberty Formula One (FWONA), which covers the company’s stake in F1 international racing. Chang said this division is a focus for Liberty Media as it seeks to continue “supporting the growth of our attractive operating assets.”

Liberty Media also owns Live Nation Entertainment (LYV), the parent company of Ticketmaster. Liberty Media Liberty Live (LLYVK) is the company’s stock tracking this portion of its business. Live Nation has been under fire recently for alleged ticket price fixing and faces a lawsuit from the Department of Justice. This has the regulator seeking a breakup of the business.

FWONA vs. LLYVK Stock: Which to Invest In?

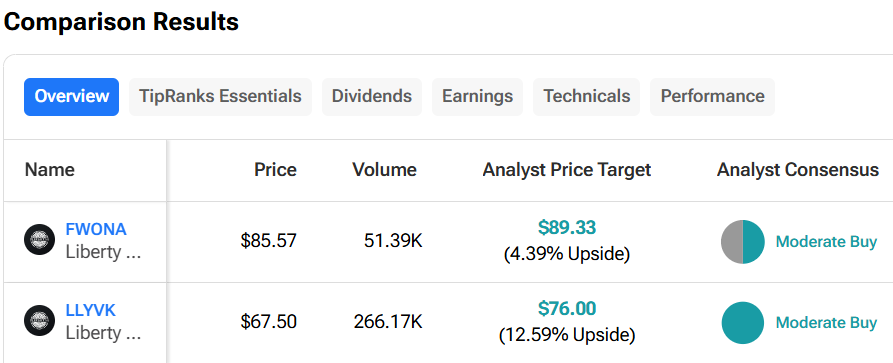

Investors considering a stake in Liberty Media can choose between FWONA or LLYVK shares. Liberty Formula One has more analyst coverage with four ratings as compared to Liberty Live’s one. Both stocks carry a Moderate Buy rating with FWONA’s $89.33 price target representing a 4.39% upside potential compared to LLYVK’s $76 price target and 12.59% upside potential.