Li Auto (NASDAQ:LI) declined in pre-market trading after announcing Q1 results that missed estimates. The Chinese EV major reported adjusted earnings of $0.17 or RMB1.21 per American Depository Shares (ADS) in Q1, compared to RMB1.35 in the same period last year. This was below analysts’ expectations of $0.24 per ADS.

The company generated total revenues of RMB25.6 billion ($3.6 billion) in the first quarter, an increase of 36.4% year-over-year, missing Street estimates of $3.69 billion. Moreover, LI delivered 80,400 vehicles in Q1, a jump of 52.9% year-over-year.

Analysts Believe LI’s Sales Volume Will Recover

LI’s management stated that while its orders in the first quarter fluctuated sequentially, it remained confident that its vehicle deliveries will continue to grow over the coming quarters.

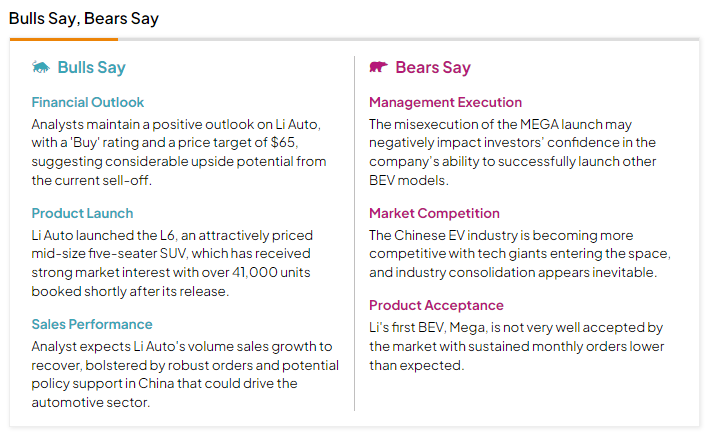

Indeed, Wall Street analysts bullish on LI echo the same. According to TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts optimistic about LI expect the company’s sales volume to recover, “bolstered by robust orders and potential policy support in China that could drive the automotive sector.”

LI Auto’s Q2 Outlook

Looking forward toward the second quarter, vehicle deliveries are likely to be between 105,000 and 110,000 vehicles, an increase in the range of 21.3% to 27.1% year-over-year. Li expects total revenues in Q2 to be between RMB29.9 billion ($4.1 billion) and RMB31.4 billion ($4.3 billion), a rise of 4.2% to 9.4% year-over-year. This is below analysts’ expectations of $5.17 billion.

Is LI Stock a Good Buy?

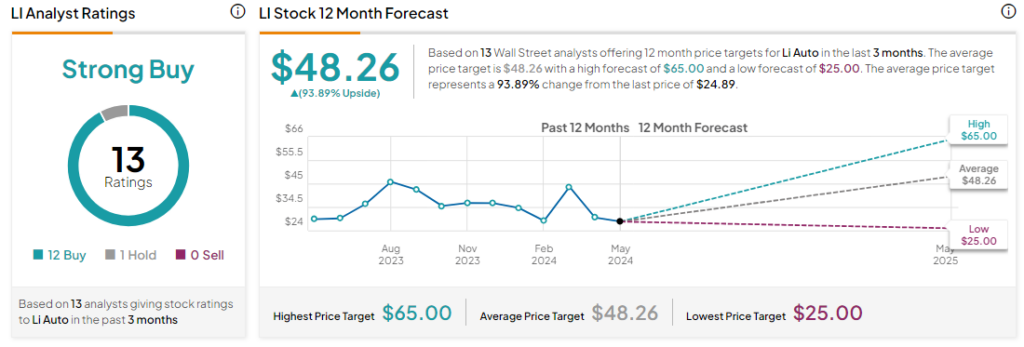

Analysts remain bullish about LI stock, with a Strong Buy consensus rating based on 12 Buys and one Hold. Year-to-date, LI has declined by more than 30%, and the average LI price target of $48.26 implies an upside potential of 93.9% from current levels. These analyst ratings are likely to change following LI’s Q1 results today.