Li Auto (NASDAQ: LI), one of the best Chinese stocks in the EV market, provided a delivery update for December 2021.

The company delivered 14,087 Li ONEs in December 2021. This represented 130% year-over-year and 4.5% sequential growth. Markedly, deliveries in the final quarter of 2021 came to 35,221, up 40.2% sequentially and 143.5% year-over-year.

In 2021, total deliveries came in at 90,491, up 177.4% year-over-year. This brings cumulative deliveries of the Li ONE since its launch to 124,088.

As of December 31, 2021, Li Auto had 206 retail stores in 102 cities, along with 278 servicing centers, and Li Auto-authorized body and paint shops, operating in 204 cities.

Official Comments

In response to the strong data, Li Auto President Yanan Shen said, “We set another record with more than 14,000 deliveries in December…In December, we released the OTA 3.0 update to all our Li ONE users, further enhancing their in-car experience. This update includes our full-stack, self-developed Navigation on ADAS (NOA), which allows over 60,000 users to enjoy safer and easier driving.”

Looking forward, Shen added, “In 2022, we will continue to bring our users safer, more convenient and more refined products and services.”

Peers

Looking at Li Auto’s peers, XPeng (NYSE: XPEV) delivered 16,000 vehicles in December, a year-over-year increase of 181%, while NIO’s (NYSE: NIO) December deliveries came in at 10,489, up 49.7%.

Wall Street’s Take

Recently, Needham analyst Vincent Yu maintained a Buy rating and a price target of $43 (33.96% upside potential).

Yu expects the company to record a loss of $0.02 per share in the fourth quarter of 2021.

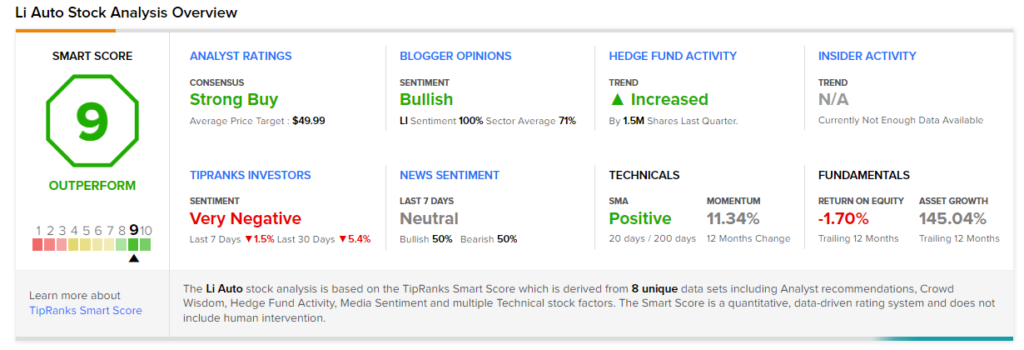

Consensus among analysts is a Strong Buy based on 8 unanimous Buys. The average Li Auto price target of $49.99 implies 55.73% upside potential from current levels. Shares have gained 25.5% over the past three months.

Smart Score

Li Auto scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the mobile app now, available on iOS and Android

Related News:

Teva Found Guilty of Fueling New York Opioid Crisis

FuelCell Books Wider-than-Feared Q4 Loss; Shares Drop 13%

Janssen Submits Biologics License Application for Teclistamab