Shares of Levi Strauss (NYSE:LEVI) fell as much as 5% after reporting mixed third-quarter Fiscal 2023 results and cutting forward sales guidance. Levi’s adjusted profit of $0.28 per share came in one cent higher than analysts’ consensus. However, revenue of $1.51 billion came in marginally short of expectations of $1.54 billion. Importantly, investors dumped the stock after the retailer cut its sales guidance for Fiscal 2024.

Details of Levi’s Q3 Results

Quarterly revenues remained flat compared to the prior-year period. The double-digit growth (14%) in the Direct to Consumer (DTC) segment helped to balance the softness in the wholesale channel (-8%), especially in North America and Europe.

Further, the denim maker’s operating margins in the reported quarter were impacted by higher operating expenses and an impairment charge of $90.2 million related to the Beyond Yoga acquisition. The charge also impacted the adjusted diluted earnings per share. In Q3FY22, Levi posted an adjusted profit of $0.40 per share.

Levi’s Cuts FY24 Sales Outlook

Owing to the unfavorable macroeconomic environment, Levi’s cut its full-year sales outlook. The apparel retailer now expects FY24 sales to grow by flat to up to 1% year-over-year, down from its previous guide of between 1.5% and 2.5% growth.

Moreover, the company said it expects adjusted earnings per share (EPS) to be at the low end of its guidance of $1.10 to $1.20.

In an interview with CNBC, President and CEO Chip Bergh said that the middle-income group is impacted by higher interest rates, inflation, and rising gas prices. Plus, in the U.S. and Europe, the prolonged warm weather conditions have affected the demand for jeans, Bergh said.

Is LEVI Stock a Good Buy?

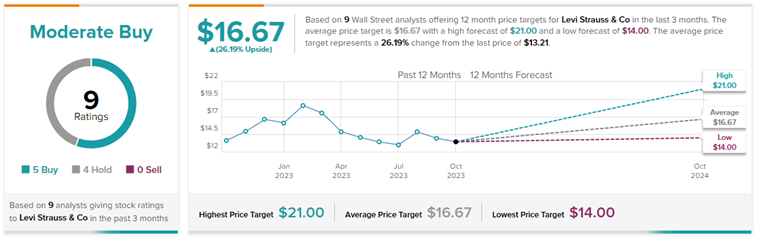

Following the Q3 print, Guggenheim analyst Robert Drbul maintained his Buy rating and $19 (43.8% upside) price target on LEVI. Drbul believes in the strength of Levi’s brand name and the management team, which has a track record of market share gains. The analyst is confident that LEVI will efficiently steer through the tough environment into 2024.

Overall, Wall Street remains cautiously optimistic about LEVI stock. Levi’s has a Moderate Buy consensus rating on TipRanks based on five Buys and four Hold ratings. The average Levi’s price forecast of $16.67 implies 26.2% upside potential from current levels. Meanwhile, LEVI stock has lost 13.1% so far this year.