Shares in Levi Strauss are spiking over 11% in Wednesday’s pre-market trading after the jeans giant surprised investors with posting a profit in the third quarter adding that financial results continued to improve in the current quarter.

Levi Strauss (LEVI) earned an adjusted 8 cents per share in the third quarter ended Aug. 23, versus analysts’ expectations for a loss of 22 cents. Sales dropped about 27% to $1.1 billion, exceeding the Street consensus of $822.3 million.

Direct-to-consumer locations and e-commerce made up 29% and 8%, respectively, of total company net revenues in the third quarter. Gross margin came in at 54.3% of net revenues during the reported period, up from 53% last year, as a result of price increases and a boost in its direct-to-consumer channel.

With store locations now reopened, the company’s e-commerce net revenues growth has remained strong, increasing 52% in the quarter year-on-year, as consumer spending continued to shift towards online shopping as a result of the global pandemic, the company said.

“As we continue to navigate the COVID-19 pandemic, we are laser focused on the areas that will drive value and enable us to emerge stronger on the other side, including elevating our already iconic brand, investing in digitization, and accelerating our efforts to diversify across geographies, product categories and distribution channels, including doubling down on our fast-growing direct-to-consumer business,” said Levi Strauss CEO Chip Bergh. “These investments are already paying off- we exceeded our expectations for the third quarter, our total digital business has doubled as a share of total net revenues, and Levi’s remains the global leader in denim, where our women’s business continues to take market share. And the brand has gotten even stronger during the pandemic.”

Commenting on the current fourth quarter, Levi Strauss forecasts a 14% to 15% drop in revenue versus the Street consensus for a 19.62% fall. Q4 adjusted diluted EPS is expected to be in the range of 14 cents to 16 cents in line with estimates.

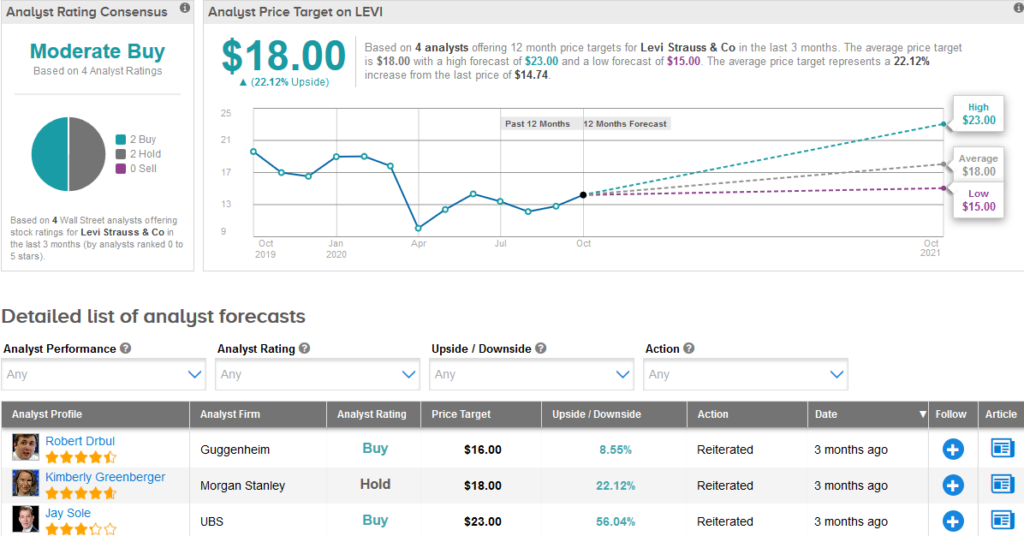

Shares in LEVI have plunged 24% this year with the $18 average analyst price target translating into 22% upside potential over the coming 12 months.

In reaction to the results, Guggenheim analyst Robert Drbul ramped up the stock’s price target to $20 from $16 and maintained a Buy rating, saying that a “premium multiple is warranted as Levi’s top-line continues to improve toward a structurally higher post-COVID profit margin structure.”

“Uncertainty remains the status quo in retail, but we continue to view Levi’s as one of the best positioned global brands,” Drbul wrote in a note to investors. “The company is ‘playing offense’ amid disruption, supported by a strong management team and financial position, as it leverages a rich history, impactful marketing, and a commitment to “profits through principles” to further grow its brand equity.”

The analyst expects LEVI to resume its dividend payment in early 2021.

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy analyst consensus. (See LEVI stock analysis on TipRanks)

Related News:

GE Gets SEC Civil Action Warning Tied To Insurance Operations; Shares Drop 3.7%

Walmart Inks £6.8B Sale Of UK’s Asda To Issa Brothers, TDR Capital

Wingstop’s System-Wide Sales Jump 33% In 3Q; Stock Is Up 61% YTD