The stock of Levi Strauss & Co. (LEVI) is down 8% after the clothing retailer reported mixed financial results and lowered its forward guidance.

The San Francisco-based company known for its blue jeans reported earnings per share (EPS) of $0.33, which was ahead of the $0.31 expected among analysts who track the company’s progress. Revenue in what was Levi’s Fiscal third quarter totaled $1.52 billion, which was below the $1.55 billion forecast on Wall Street. Sales were flat from a year earlier.

Looking ahead, Levi Strauss reaffirmed its full-year earnings guidance of $1.17 to $1.27 per share, which is in line with analyst expectations of $1.25. However, the company lowered its revenue guidance, saying it now expects sales to grow 1% compared to a previous outlook of 1% to 3% growth. The mixed results and lower sales forecast are pressuring LEVI stock.

Selling the Dockers Brand

Management at Levi Strauss blamed the poor results on the Dockers brand, which they now plan to sell. Dockers, which has been around since 1986 and primarily sells khaki pants, saw its sales decline 15% to $73.7 million in the most recent quarter. Had it not been for Dockers, Levi Strauss would have reported a much better quarter and guidance, said management.

“Our view financially is (that) the exit of Dockers will improve the company’s overall margins and also minimize volatility in top line growth,” said Levi’s chief financial officer (CFO) Harmit Singh in an interview on CNBC. Levi Strauss has hired Bank of America (BAC) to lead the sale of Dockers. Levi’s also continues to shift its strategy to selling directly to consumers, said the company.

Is LEVI Stock a Buy?

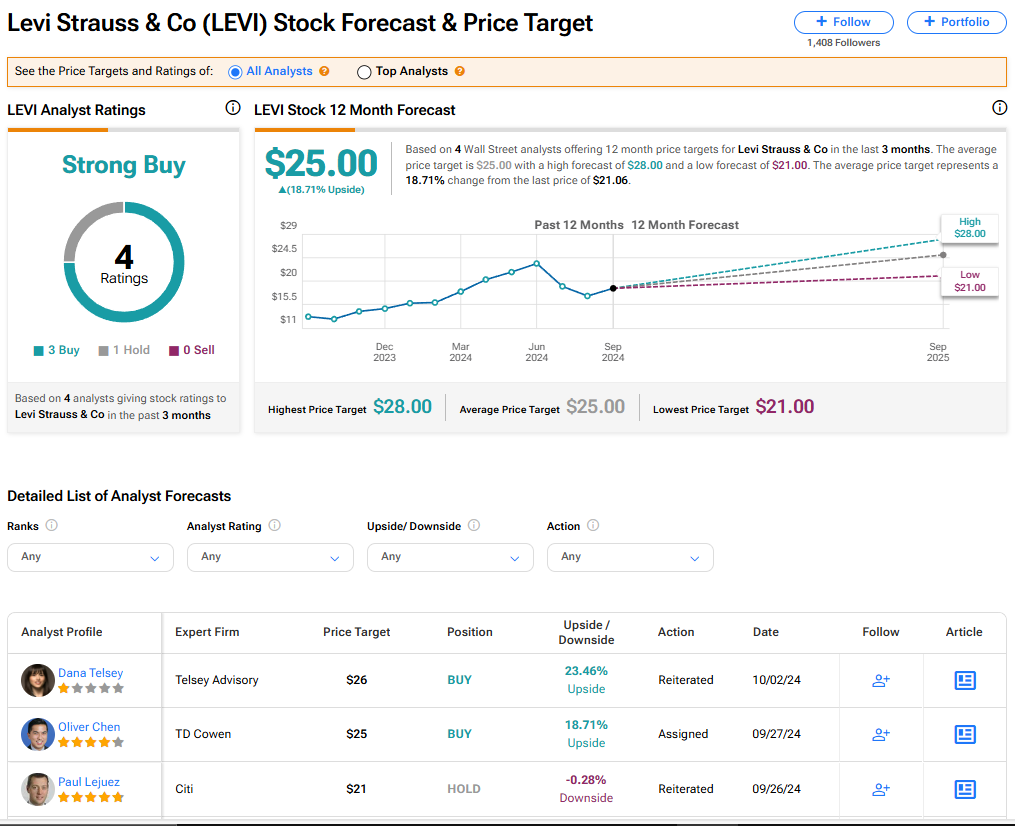

Levi Strauss stock has a consensus Strong Buy rating among four Wall Street analysts. This rating is based on three Buy and one Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average LEVI price target of $25.00 implies 18.71% upside from where the shares currently trade.