During the pandemic, the pool construction and renovation industry saw an unprecedented surge as consumers confined to their homes redirected their income towards improving their home lives and making them more convenient. As a result, Leslie’s (NASDAQ:LESL), the nation’s premier retailer of swimming pool supplies and products, significantly benefited.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, consumer spending trends have evolved since, leading to a decline in pool-related expenditures. This shift in consumer behavior has directly impacted Leslie’s financial performance, so Investors may want to seek more attractive options until this market recovers.

Leslie Leads a Declining Industry

Leslie’s is the preeminent retailer of swimming pool products and related supplies. The company operates more than 1,000 stores in 37 states in the US. Aside from its physical stores, Leslie’s also serves its customers in the residential and commercial space through online and special order channels, boasting an inventory of over 30,000 items.

According to credit card data, the industry witnessed a drop in specialty pool sales in eight of the last ten quarters. However, Leslie’s has outperformed the industry average by growing its sales approximately 380 basis points faster than the industry average during that time.

Recent Financial Results & Outlook

Leslie’s recently announced results for fiscal Q2, 2024. The reported revenue of $188.66 million missed analyst estimates of $200.92 million, marking an 11.4% decrease compared to the $212.8 million reported in the previous year. The downturn in sales was reportedly impacted by adverse weather conditions, resulting in a decline of 12.1% in comparable sales and reducing pool openings by 19%. However, reported earnings per share of -$0.17 outperformed the analyst’s estimated EPS of -$0.18.

Despite the financial setbacks, Leslie’s reduced its funded debt from $965.8 million in April 2023 to $882.7 million in March 2024. It also decreased its revolving credit facility from $172 million to $97 million over the same period. As of March 30, 2024, the company’s reported cash and cash equivalents totaled $8.4 million.

Management has maintained its forecast for fiscal 2024, projecting sales between $1.41 billion and $1.47 billion. Gross profit is expected to range from $550 million to $573 million, with a net income of $32 million to $46 million. The company anticipates an adjusted net income between $46 million and $60 million and an adjusted EBITDA of $170 million to $190 million. Expected adjusted diluted earnings per share are listed as $0.25 to $0.33, with 185 million diluted weighted average shares outstanding, in line with consensus expectations for $0.28.

What Is the Price Target for LESL Stock?

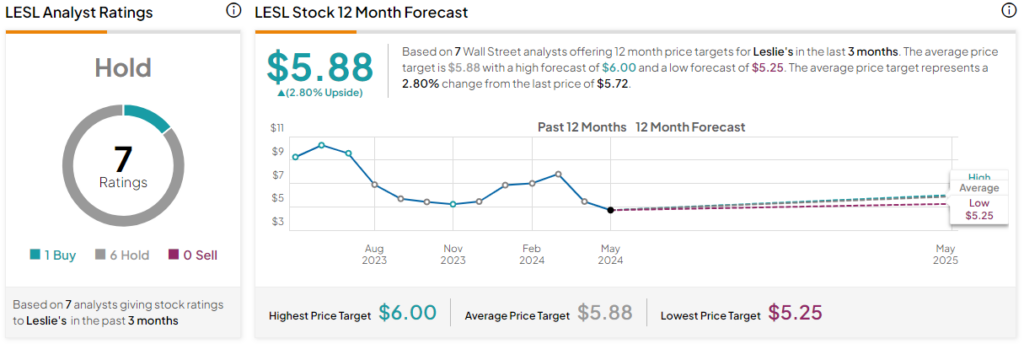

Analysts following the company have been cautious about the stock’s near-term prospects. Mizuho analyst David Bellinger recently lowered the price target from $7 to $6 and maintained a Neutral rating on the shares, citing the company’s fiscal Q2 as further evidence of ongoing nearer-term challenges.

Overall, Leslie’s is rated a Hold based on the aggregate ratings and price targets assigned over the past three months by seven Wall Street analysts. The average price target for LESL stock is $5.88, representing a 2.80% change from current levels.

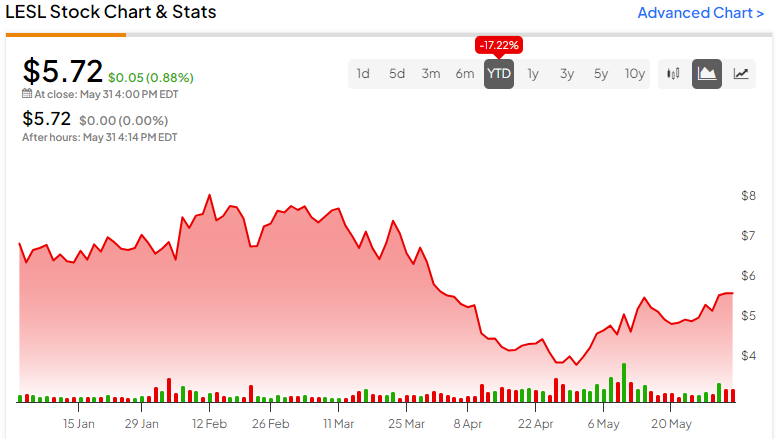

The stock had been trending downward, losing over -27.5% in the past 90 days. However, it has regained 9% in the past week. It sits at the lower end of its 52-week price range of $3.79-$11.16 and shows positive price momentum, trading above its 20-day (5.17) and 50-day (5.34) moving averages.

The TTM P/E ratio of 71.50x towers over the Specialty Retail industry average of 18.73x, though the P/S ratio of 0.75x is more in line with the industry average of 0.82x. This suggests the company is maintaining a relatively reasonable top line but struggling to translate that to comparable earnings levels, perhaps the downside of being the most prominent competitor (with the associated cost structure) in the market.

Bottom Line on LESL

In the face of an industry downturn, Leslie’s has done an adequate job of maintaining sales relative to its peers. Even though the company’s stock has been under pressure, it has begun rebounding, and if the company can make further progress on growing EPS, that upward price momentum could continue. However, overall market trends are not compelling at this time, and investors may want to hold off and wait for signs of recovery.