Lennar Corporation, a home construction company, reported better-than-expected fiscal 1Q (ended Feb. 28) results, driven by a strong housing market due to low interest rates. Shares rose 1.6% in Tuesday’s extended trading session after closing 1.5% lower on the day.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Lennar’s (LEN) 1Q earnings more than doubled to $3.20 per share on a year-over-year basis and surpassed analysts’ expectations of $1.71. Total revenues of $5.33 billion beat the Street’s estimates of $5.13 billion and increased 18% from the year-ago period.

The company’s revenues from home sales came in at $4.9 billion in the quarter, up 18% year-over-year, driven by a 19% rise in the number of home deliveries. Gross margin on home sales was 25%, up 450 basis points.

Lennar’s Executive Chairman Stuart Miller commented, “The housing market has proven to be resilient in the current environment and we expect it to continue to be a significant driver in the recovery of the overall economy.”

“As we look ahead to our second quarter, we expect to deliver approximately 14,200 – 14,400 homes while we expect homebuilding margins to remain at 25.0% despite rising material and labor costs,” Miller added. (See Lennar stock analysis on TipRanks)

For the fiscal year 2021, the company anticipates home deliveries to be in the range of 62,000-64,000.

On March 16, Wolfe Research analyst Truman Patterson initiated coverage of the stock with a Buy rating.

Patterson initiated “11 homebuilders and one land developer with a Market Overweight rating based on a constructive multi-year industry outlook and robust demand expectations over the next couple quarters.”

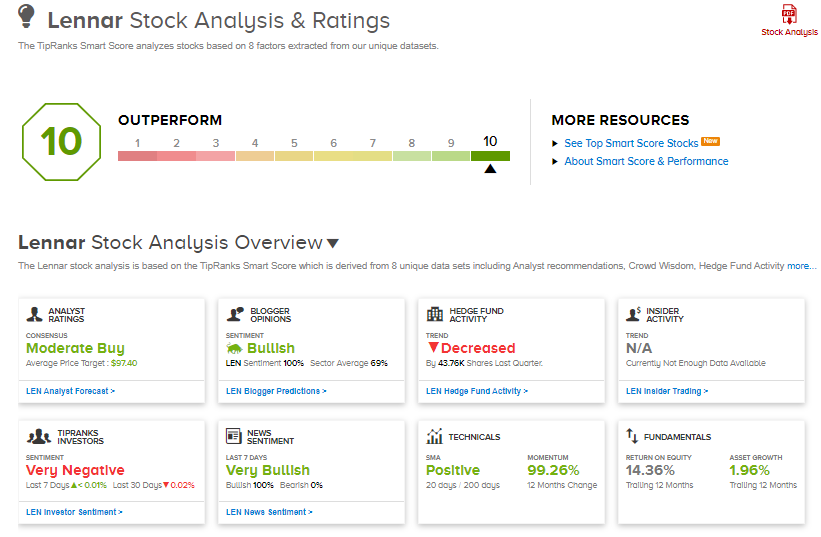

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 8 analysts suggesting a Buy and 3 analysts recommending a Hold. The average analyst price target of $97.40 implies 9.8% upside potential to current levels.

Lennar scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

International Seaways Reports Larger-Than-Expected Quarterly Loss; Shares Slide 3%

Aegion Gets New Buyout Offer For An Undisclosed Sum; Shares Pop 12.4%

Sesen Bio’s Quarterly Loss Meet Analysts’ Expectations