The lending landscape has entered a digital revolution, reshaping the traditional borrowing experience. This surge of technological innovations has elevated digital lending platforms, which offer faster loan approval processes, reduced overhead costs, and improved accessibility. One of the frontrunners in this space is LendingTree (TREE). After reporting exceptional Q2 growth, with revenue surpassing predictions, its stock has witnessed an impressive spike of roughly 35% in the past month.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

LendingTree market position and diverse business model are set to drive increased revenue generation throughout the year. The shares trade at a reasonable valuation compared to industry peers, making it an attractive option for investors interested in exposure to the sector.

LendingTree Anticipates Further Growth

LendingTree is an online marketplace for financial services, providing a platform to support consumers on a range of financial services, from mortgage loans to personal loans, insurance, and more.

In its consumer segment, the company has enjoyed a 9% sequential revenue growth, supported by a 44% increase in high-intent consumer traffic, resulting in a 34% boost in loans closed for partners. Despite a sluggish housing market with higher mortgage rates and a limited supply of homes, LendingTree managed a 6% sequential revenue growth in the home equity segment.

Furthermore, over the past two years, the company has demonstrated significant growth, particularly in the insurance sector, where it has increased its market share despite budgetary constraints. Revenues in its insurance and Visual Merchandising (VMD) segments have grown by 109% and 47%, respectively, from the previous year. LendingTree also plans to employ similar growth strategies in the lending sector, expecting to benefit from anticipated changes in lending conditions, such as potential interest rate reductions.

LendingTree’s Recent Financial Results & Outlook

The company has recently released its financial results for Q2 2024, showcasing a robust growth trajectory. Revenue of $210.10 million exceeded analysts’ estimates of $187.36 million, a 15% increase from the same quarter last year and a 25% jump from Q1. Net income jumped from a loss in Q2 2023 to $7.8 million despite the 31% increase in variable marketing expenses. Earnings per share of $0.54 significantly surpassed consensus estimates of $0.46.

Management has revised guidance for the Fiscal year 2024, projecting revenue between $830 – $870 million, an increase from the prior range of $690 – $720 million. The Variable Marketing Margin is anticipated to be around $280 – $300 million, while the Adjusted EBITDA is around $85 – $95 million. For the third quarter of 2024, revenue is expected to be between $230 – $260 million, with a Variable Marketing Margin of $73 – $80 million and an Adjusted EBITDA of $23 – $27 million.

What Is the Price Target for TREE Stock?

After a significant decline in the face of historic rate increases, the company has rebounded, with its shares climbing over 128% in the past year. The stock trades at the high end of its 52-week price range of $10.12 – $52.76 and shows ongoing positive price momentum, trading above its 20-day (43.02 ) and 50-day (42.42 ) moving averages. With its EV to EBITDA (TTM) of 22.90, sitting below the Financial Conglomerates industry average of 29.68, the company trades at a relative discount to industry peers.

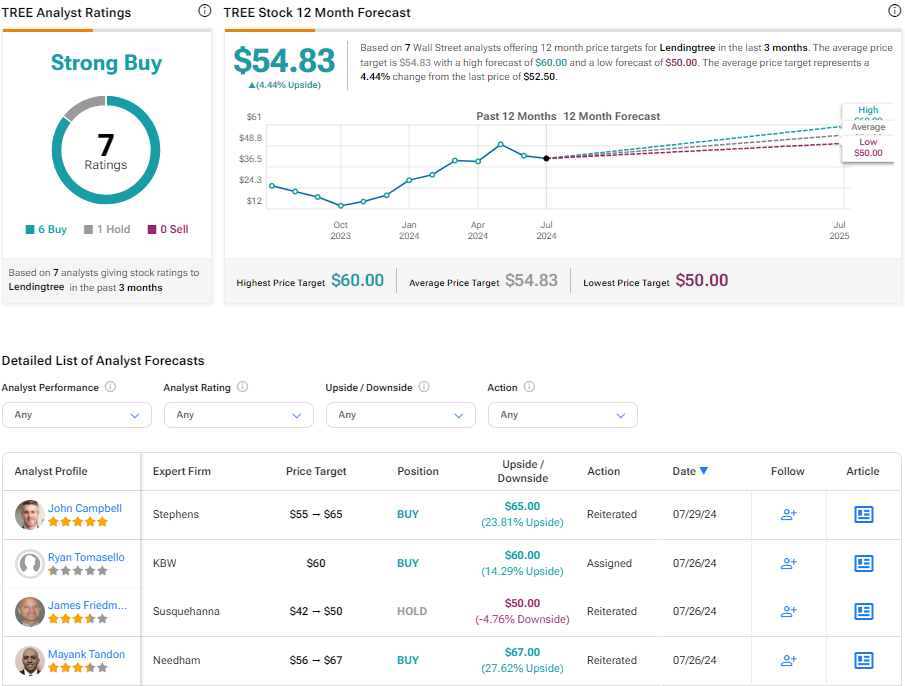

Analysts following the company have been bullish on the stock. For example, Truist analyst Youssef Squali, a five-star analyst according to Tipranks’ ratings, recently raised the price target on the shares from $55 to $60 while maintaining a Buy rating, noting the Q2 earnings beat and much stronger than expected Q3 outlook.

Based on seven analysts’ recommendations and recently issued price targets, LendingTree is rated a Strong Buy overall. The average price target for TREE stock is $54.83, translating to a potential upside of 4.44% from current levels.

TREE Stock in Summary

Emerging as a leader in the digital lending revolution, LendingTree has defied expectations with exceptional Q2 growth. The shares have shown positive momentum, recently spiking, while still trading at a reasonable valuation relative to industry peers, making them an attractive investment option.