Everybody’s out to make a buck these days, though some methods are a lot less savory—or legal—than others. Indeed, online loan marketplace LendingTree (NASDAQ:TREE) lost nearly 2.5% in Friday afternoon’s trading after reports emerged about hackers selling off a substantial amount of LendingTree data after “unauthorized access” to said records.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Reports noted that the “unauthorized access” in question targeted a cloud database hosted by Snowflake (NYSE:SNOW), which contained customer information connected to a LendingTree subsidiary, QuoteWizard. Several listings on various cybercriminal-related forums have cropped up, and the data generated is being sold to the highest bidder.

Despite this, LendingTree notes that there was no impact on operations, and investigations are still going on as to just how this hack took place to begin with. Some assert that it’s part of an earlier hack on Snowflake, which landed login credentials for up to 165 Snowflake customers.

All This and a New CFO

This news comes at an odd time for LendingTree, as its previous CFO, Trent Ziegler, announced plans to depart the company effective August 9. He will be replaced by Jason Bengel, who currently serves as part of the management team. He’ll have to navigate a future where fewer people may actually trust the company. In fact, LendingTree seems to be taking the brunt of this, as Snowflake stock is only down fractionally in Friday afternoon’s trading.

Is LendingTree Stock a Good Buy?

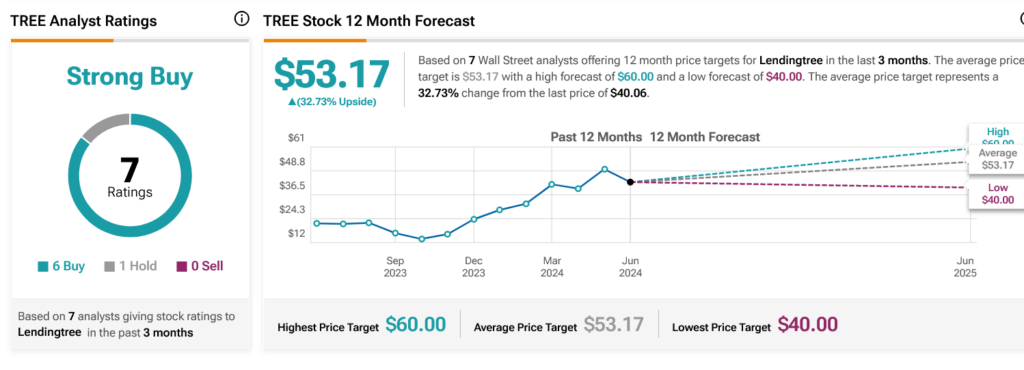

Turning to Wall Street, analysts have a Strong Buy consensus rating on TREE stock based on six Buys and one Hold assigned in the past three months, as indicated by the graphic below. After an 86.85% rally in its share price over the past year, the average TREE price target of $53.17 per share implies 32.73% upside potential.