Shares of insurance products provider Lemonade, Inc. (LMND) have slumped around 45.2% so far this year. The company recently reported better-than-expected Q3 performance with its top-line registering 101% growth over the previous year.

Additionally, LMND also announced the $500 million acquisition of data science company Metromile (MILE) in an all-stock transaction. Keeping these developments in mind, let us take a look at the changes in LMND’s key risk factors that investors should know.

Risk Factors

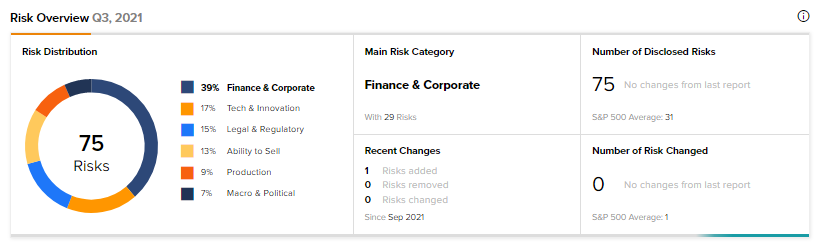

According to the TipRanks Risk Factors tool, LMND’s top risk category is Finance & Corporate, accounting for 39% of the total 75 risks identified. In its recent Q3 report, the company has added one key risk factor under the Macro & Political risk category.

LMND highlighted the uncertainty induced by geopolitical situations. LMND conducts certain operations in Israel, where some of its officers, employees, and directors reside. The political, economic, and military situation in Israel and its surrounding region may directly impact LMND’s Israeli operations as well as its business and financial condition. (See Insiders’ Hot Stocks on TipRanks)

Compared to a sector average of 9%, LMND’s Macro & Political risk factor is at 7%.

Wall Street’s Take

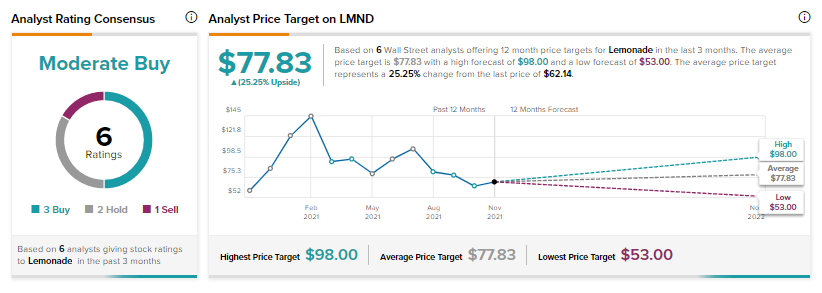

On November 10, Oppenheimer analyst Jason Helfstein reiterated a Buy rating on the stock and decreased the price target to $85 from $95, which implies upside potential upside 36.8%.

Consensus on the Street is a Moderate Buy based on 3 Buys, 2 Holds, and 1 Sell. At the time of writing, the average Lemonade price target was $77.83, which implies upside potential of 25.2% for the stock.

Related News:

Gain Therapeutics Reports Quarterly Loss; Shares Rise

Moderna Presents Data from Phase 1 Clinical Study of mRNA Triplet Program

Boeing to Initiate Three New Freighter Conversion Lines