If it’s not one thing, it’s another at Boeing (BA), as the beleaguered aircraft maker finds itself staring down both legal and labor trouble in recent events. Investors took it mostly in stride, though, sending Boeing shares down only fractionally in Wednesday afternoon’s trading.

First came the legal troubles. The National Transportation Safety Board (NTSB) is getting in on the action with Boeing, announcing today that it had 20 hours worth of hearings planned for the door plug failure on that Alaska Airlines (ALK) flight back in January. The hearings will run over two days, 10 hours per day, and will review a wide range of points, starting with manufacturing and oversight procedures on the 737 MAX line.

It’s easy to wonder, though, how moot these proceedings will end up being, as Boeing has recently shifted a lot of its policies and procedures since the incident, mostly under the Federal Aviation Administration’s (FAA) guidance. It also still operates under a production cap, which is already a major change in and of itself.

And Then the Employees Got Restless

At quite possibly the worst time for Boeing, employees decided that now was the time to reassert their presence. In fact, Boeing’s workers in Washington state are poised to vote later today on a measure that would give the union a strike mandate. Boeing’s employees are poised to start a full negotiation for the first time in 16 years, and that could make for a challenging time all around.

In fact, Boeing employees are looking for a major coup just as Boeing’s cash flow is at its worst. The union is looking for a 40% raise. Perhaps the only saving grace for Boeing is that the union cannot launch a strike before September 12, when their current contract expires. The negotiation process is only beginning, and it’s safe to say it’s not looking good for Boeing if the union sticks to that demand.

Is Boeing a Buy, Sell, or Hold?

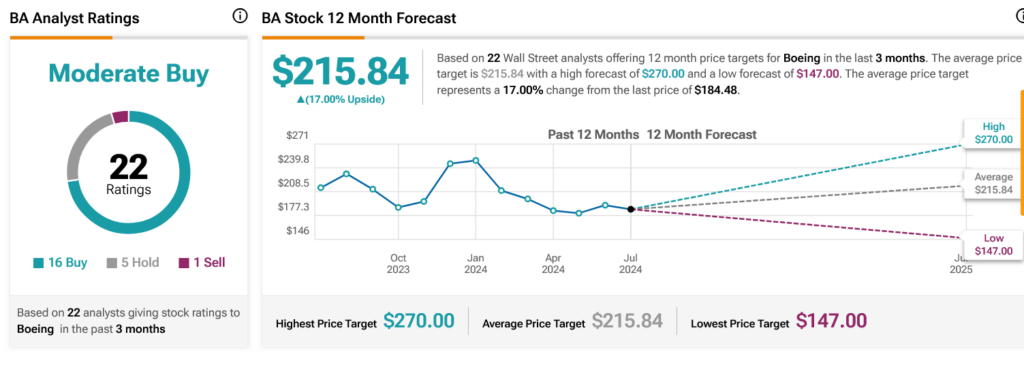

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 16 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 12.54% loss in its share price over the past year, the average BA price target of $215.84 per share implies 17% upside potential.

Questions or Comments about the article? Write to editor@tipranks.com