Johnson & Johnson (NYSE:JNJ) is a lot of things to a lot of people: pharmaceutical stock, household name, dividend kingpin – the list goes on. But it’s also become lawsuit bait and a big decliner today as more legal troubles hit the stock price hard. Word from the Third Circuit court delivered the hammer blow to Johnson & Johnson: its recent bankruptcy—part of a larger scheme known as the “Texas two-step”—would not prove sufficient protection against the talc lawsuits targeting the company.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Under a Texas two-step plan, a company creates a subsidiary company, assigns all those lawsuits to the subsidiary, and lets it all go down in flames. Representatives of a committee representing the roughly 38,000 plaintiffs involved noted that the ruling would keep “…wealthy and solvent corporations from employing corporate machinations to evade that justice.”

Though in Johnson & Johnson’s case, evasion wasn’t so much an issue. It planned to fully fund any settlement that its targeted subsidiary reached. Johnson & Johnson’s recent earnings beat makes that no surprise. However, that proved to be Johnson & Johnson’s undoing; a fully funded settlement meant the subsidiary was in no financial trouble. Thus, the bulk of Chapter 11’s tools were unavailable.

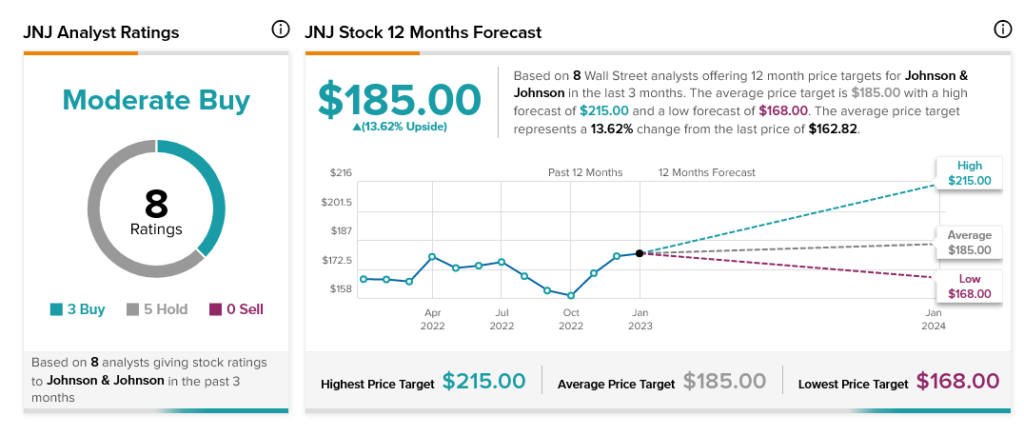

The latest bout of legal troubles isn’t swaying Wall Street, though. Currently, analyst consensus calls Johnson & Johnson stock a Moderate Buy. Further, thanks to its average price target of $185, JNJ has 13.62% upside potential.