TherapeuticsMD (TXMD) announced that it has received a private investment worth $15 million from one of its major shareholders, Rubric Capital Management.

The investment comprises the 565,000 company shares as well as 15,000 shares of a new series of Series A preferred stock with a liquidation value of $1,333 per share. The company will utilize the proceeds to meet its near-term operating capital requirements.

Upon completion, Rubric will become a major owner of TXMD stock with an 18.3% stake in the company.

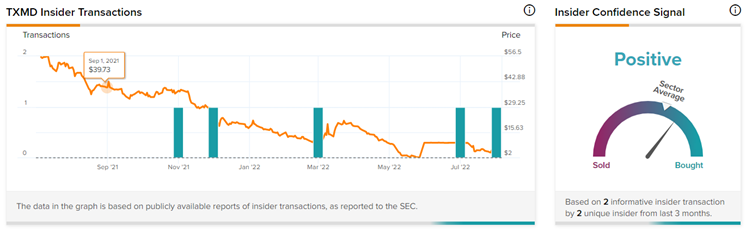

Notably, this is not the only transaction made by Rubric Capital Management. Two weeks ago, it made informed Buys of 82,580 shares for $467,460 at $5.66 price levels.

Rubric Capital Management’s recent transactions are listed on TipRanks’ Insider Trading Activity tool.

The tool also shows that Insider Confidence Signal is currently Positive for TherapeuticsMD, with corporate insiders buying TXMD stock worth $15.5 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that boasts either a Very Positive or Positive insider confidence signal.

Sixth Street Partners Agrees to Extend the Maturity Date of its Financing Debt

Separately, the company also entered into an amendment with its lender, Sixth Street Specialty Lending, Inc., to extend the maturity date of its financing debt to September 30, 2022. In exchange, Sixth Street received warrants to buy 200,000 shares at an exercise price of $0.01.

Sixth Street could receive an additional 125,000 warrants if the company chooses to further extend the monthly payment dates. TXMD has an option to further extend the maturity date until October 31 and November 30 if it gets additional equity capital of $7 million per extension.

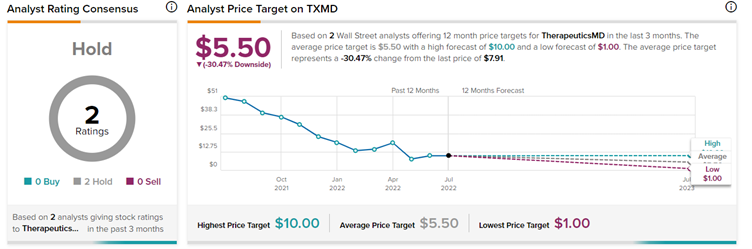

Wall Street’s Neutral Stance on TXMD

According to TipRanks, which also provides a comprehensive list of daily insider transactions, TXMD is a Hold, based on two Hold ratings. The average TXMD price target of $5.50 implies 30.47% downside potential.

Concluding Thoughts

Shares of TXMD have lost almost 85% of its market capitalization over the past year.

The company has recently been in choppy waters with the recent termination of its merger deal with Athene Merger and a potential risk of bankruptcy.

The fresh injection of capital by major shareholder and hedge fund Rubric Capital Management may help relieve some of the challenges facing the company.