Normally, shareholders take news of layoffs better than anyone else, especially employees. Huge cost savings are generally welcome to the people whose investments at least partially fund operations. But that wasn’t so for gambling company Penn National Gaming (PENN), who lost nearly 2% in Thursday afternoon’s trading. Penn currently employs about 20,000 people. But before too much longer, that number will be slightly reduced, down 100 people as it prepares to focus on ESPNBet. It’s a $2 billion partnership, so Penn has a lot riding on this partnership taking shape and producing revenue.

The layoffs had been coming for some time and were delayed after Penn acquired theScore, which operates out of Canada. Reports noted that Penn deliberately kept redundant staff to augment its technology and move its sportsbook operations to theScore’s platform. Since theScore had an excellent platform—CEO Jay Snowden called it “best-in-class”—Penn took it over and set up shop therein.

Poised to Grow Further

Yet, even as Penn pares back staff, it’s also poised to grow further. Planned for the near term are further “product enhancements” and a closer integration with partner ESPN (DIS). Penn’s growth plans aren’t all working out, though; Donerail Group, via managing partner Will Wyatt, is looking for Penn to get rid of its casino business, which by itself could reportedly be worth as much as double Penn’s current market cap or more.

Is Penn National Gaming Stock a Buy?

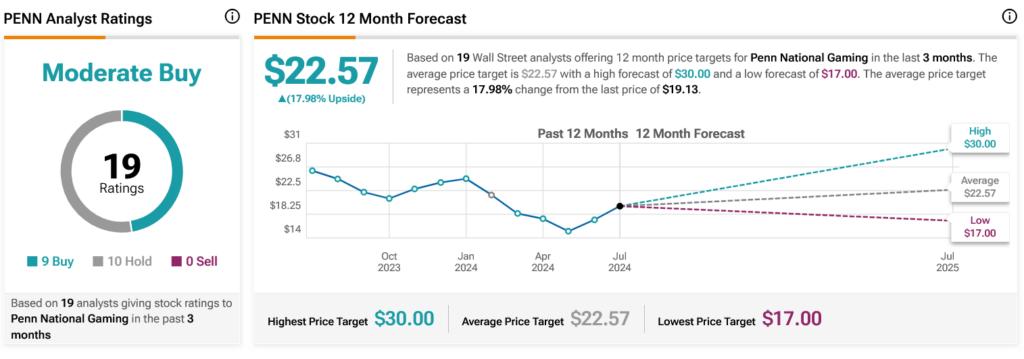

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PENN stock based on nine Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 30.7% rally in its share price over the past year, the average PENN price target of $22.57 per share implies 17.98% upside potential.