Lattice Semiconductor Corp. sees better-than-expected sales in the first quarter after earnings topped the Street consensus in 4Q.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Lattice’s (LSCC) 4Q earnings of $0.19 per share beat the consensus estimates of $0.17 per share and grew 11.8% year-over-year, driven by gross margin expansion. The semiconductor company’s 4Q revenues rose about 6.9% year-over-year to $107.2 million and exceeded the Street’s estimates of $103.2 million.

The company’s CEO Jim Anderson said, “Profitability increased significantly for the full year 2020, as we continued to execute on our strategy. We saw double-digit year-over-year revenue growth in our two largest markets, communications and computing, and industrial and automotive, which are long-term growth drivers.” (See Lattice Semiconductor stock analysis on TipRanks).

As for 1Q, Lattice Semiconductor projects revenue to land between $106 million and $114 million, higher than analysts’ estimates of $103.4 million.

Following the strong results, Robert W. Baird analyst Tristan Gerra raised the stock’s price target to $50 (2.8% upside potential) from $40 and maintained a Buy rating. In a note to investors, the analyst said, “Strong 1Q outlook is primarily driven by non-Nexus products, which is incrementally positive as it suggests Lattice is seeing strong momentum with prior node products, notably with server/new client computing design wins, while Nexus will add yet another revenue driver this year.”

Gerra added, “Surge in interest for security solutions in servers positions Lattice well given its strong and differentiated product offering. Strong supply planning immunizes Lattice in the current constrained environment.”

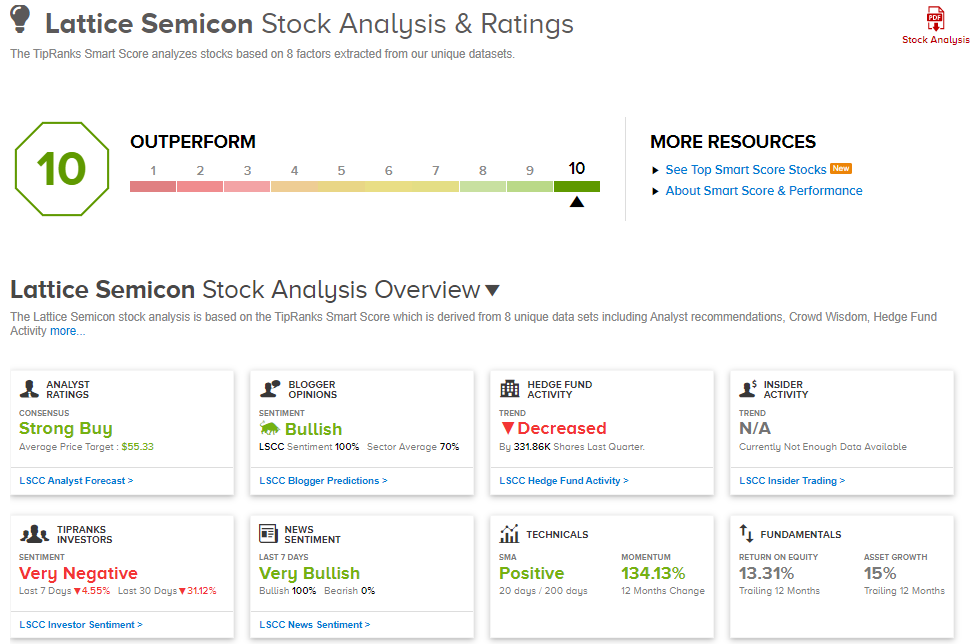

Overall, consensus among analysts is a Strong Buy based on 4 unanimous Buys. The average analyst price target of $57.25 implies upside potential of about 18% to current levels. That’s after shares exploded more than 134% over the past year.

LSCC scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

RingCentral’s 2021 Guidance Tops Estimates After 4Q Beat

IPG Photonics Posts Profit In Fourth Quarter; Shares Gain

Denny’s 4Q Revenues Miss Estimates Due To COVID-19 Pandemic