Lam Research Corporation (LRCX), a U.S.-based global supplier of wafer fabrication equipment and related services to the semiconductor industry, has posted lower-than-expected revenues for the first quarter of Fiscal 2022 (ended September 26). Meanwhile, earnings during the quarter beat analysts’ expectations. Following the results, shares of the company declined 2.6% in Wednesday’s extended trading session.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company reported adjusted earnings of $8.36 per share, topping analysts’ expectations of $8.21 per share. However, the revenue of $4.3 billion lagged the Street’s estimates of $4.32 billion but was up 34.3% from the year-ago period.

Additionally, adjusted gross margin came in at 46%, down 50 basis points (bps) from the June quarter of Fiscal 2021, while adjusted operating margin stood at 32.4%, down 20 bps.

See Analysts’ Top Stocks on TipRanks >>

The company’s system revenues increased 35.8% year-over-year, while customer support-related revenue and other surged 34%. (See Lam Research stock charts on TipRanks)

The CEO of Lam Research, Tim Archer, said, “Driven by strong demand and solid execution, Lam delivered its sixth consecutive quarter of record revenue and earnings per share. In a robust wafer fabrication equipment environment, Lam is delivering the innovation needed for the success of our customers’ semiconductor manufacturing roadmaps.”

For the December quarter of Fiscal 2022, Lam Research expects adjusted EPS between $7.95 and $8.95 per share, compared to the consensus estimate of $8.47. Additionally, it anticipates revenue in the range of $4.15 billion to $4.65 billion, versus analysts’ expectations of $4.4 billion.

Following the first-quarter results, Mizuho Securities analyst Vijay Rakesh reiterated a Buy rating on the stock but decreased the price target to $700 (23.8% upside potential) from $725.

Rakesh foresees a “strong foundry/logic outlook but a weaker Memory (~60-70% of LRCX revenue) industry outlook limiting upside to multiples.”

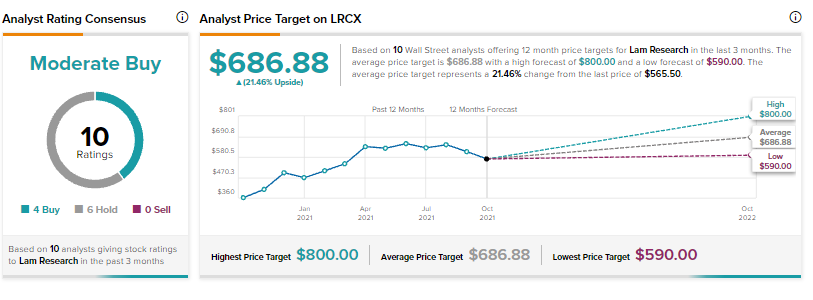

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 4 Buys and 6 Holds. The average Lam Research price target of $686.88 implies 21.46% upside potential to current levels. Shares have surged 54.3% over the past year.

Related News:

Synovus’ Q3 Earnings Top Estimates; Shares Gain

Castle Biosciences Inks $30M Deal to Acquire Cernostics; Shares Rise

Atea Reveals Topline Results of Phase 2 MOONSONG Trial; Shares Crash 66%