Kohl’s Corp. (NYSE:KSS) plummeted in trading after the department store retailer swung to a loss in the first quarter. The retailer reported a loss of $0.24 per share in the first quarter, compared to earnings of $0.13 per diluted share in the same period last year. Analysts were expecting the company to report earnings of $0.05 per share.

KSS’s Revenues Fall Short of Estimates

The company posted net sales of $3.2 billion, a decline of 5.3% year-over-year, with comparable sales down 4.4% in the first quarter. This was below consensus estimates of $3.4 billion.

Kohl’s management stated that its Q1 results fell short of expectations and did not reflect its strategic initiatives. The company mentioned that regular price sales rose year-over-year, with a strong performance in its underpenetrated categories, including women’s clothing and the cosmetics brand Sephora.

However, lower clearance sales dragged the retailer’s comparable sales down by over 600 basis points.

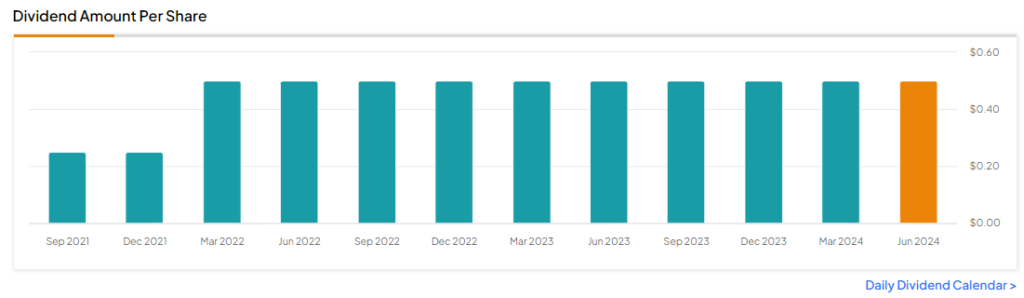

Kohl’s Quarterly Dividends

The company’s Board of Directors declared a quarterly cash dividend of $0.50 per share, payable on June 26 to shareholders of record at the close of business on June 12, 2024.

Kohl’s FY24 Outlook

Looking forward, management lowered its FY24 guidance and now expects its net sales to decline between 2% and 4%, while analysts had projected sales to gain by 0.2%. Additionally, Kohl’s anticipates its FY24 diluted earnings to be in the range of $1.25 to $1.85 per share, far below the consensus estimates of $2.34 per share.

Is KSS Stock a Good Buy?

Analysts remain sidelined about KSS stock, with a Hold consensus rating based on two Buys, four Holds, and three Sells. Over the past year, KSS has increased by more than 50%, and the average KSS price target of $25.22 implies a downside potential of 7.5% from current levels. These analyst ratings are likely to change following Kohl’s Q1 results today.