The Kroger Co. (NYSE:KR) is slated to release its first quarter Fiscal 2024 results on June 20, before the market opens. The company’s focus on providing fresh products sets it apart from other retailers. However, a weak consumer spending scenario due to high inflation might have impacted Kroger’s Q1 performance to some extent.

Kroger operates retail food and drug, multi-department, jewelry, and convenience stores.

KR – Q1 Expectations

Wall Street expects Kroger to report sales of $44.87 billion in Q1, down marginally year-over-year. Further, the company is expected to post earnings of $1.35 per share, reflecting a decrease of 10.6% from the year-ago quarter.

Interestingly, KR has a strong quarterly performance history. It has exceeded earnings expectations for 15 consecutive quarters.

Analysts’ Opinions

Ahead of the Q1 results, four Wall Street analysts rated Kroger stock a Buy. Among the bullish analysts, Evercore ISI analyst Michael Montani anticipates that the company will either meet or exceed expectations in the first quarter. Moreover, he finds KR stock’s valuation attractive at its current level.

Another five-star analyst, Joe Feldman from Telsey Advisory, expects KR to meet estimates in Q1.

Options Traders Anticipate a Modest Move

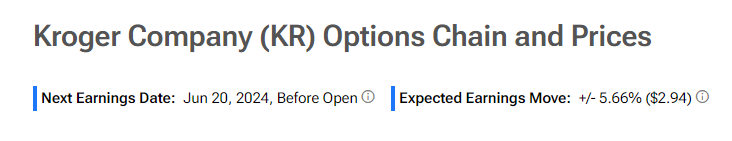

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you. Indeed, it currently says that options traders are expecting a modest 5.66% move in either direction.

Is KR a Good Stock to Buy Today?

Turning to Wall Street, analysts have a Moderate Buy consensus rating based on five Buys, one Hold, and one Sell assigned in the past three months. After a 16.7% rally in its share price over the past six months, the analysts’ average price target on Kroger stock of $59.71 implies 14.9% upside potential.