Investors looking to avoid investments in big banks could consider taking a look at regional bank ETFs. These ETFs invest in the stocks of smaller banks and provide exposure to the financial sector. By leveraging the TipRanks ETF Screener to scan for regional bank ETFs with more than 10% upside potential projected by analysts, we have shortlisted two such funds: KRE and KBWR.

Let’s take a deeper look at these two ETFs.

SPDR S&P Regional Banking ETF (KRE)

The KRE ETF provides exposure to small and mid-cap banking stocks and tracks the performance of the S&P Regional Banks Select Industry Index. The ETF has $2.58 billion in assets under management (AUM), with the top 10 holdings contributing 25.21% of the portfolio. Importantly, it has a low expense ratio of 0.35%. The KRE ETF has returned 15.6% in the past six months.

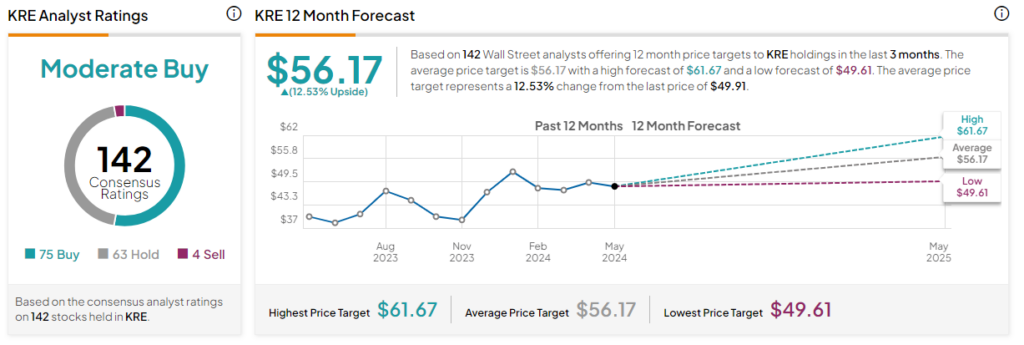

Overall, the KRE ETF has a Moderate Buy consensus rating. Of the 142 stocks held, 75 have Buys, 63 have a Hold, and four have a Sell rating. The analysts’ average price target on the KRE ETF of $56.17 implies a 12.53% upside potential from the current levels.

Invesco KBW Regional Banking ETF (KBWR)

The ETF seeks to track the performance of the KBW Nasdaq Regional Banking Index and invests at least 90% of its total assets in securities of publicly traded U.S. regional banking and thrift companies. The ETF has $55.17 million in AUM, with the top 10 holdings contributing 28.76% of the portfolio. Meanwhile, the expense ratio of 0.35% is encouraging. Interestingly, the KBWR ETF has generated a return of 9.4% over the past six months.

On TipRanks, KBWR has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 51 stocks held, 26 have Buys, 23 have a Hold rating, and two have a Sell. The analysts’ average price target on the KBWR ETF of $56.47 implies a 12.62% upside potential from the current levels.

Concluding Thoughts

Overall, ETFs are a low-cost, diversified, and transparent way to participate in the market. Investors looking for exposure to the regional banking sector could consider taking a look at KRE and KBWR ETFs due to the upside potential expected by analysts.

Questions or Comments about the article? Write to editor@tipranks.com