Private equity firm KKR is in advanced talks to buy a stake in Reliance Retail Ventures Ltd., a unit of India’s largest retailer Reliance Industries Ltd., according to a Bloomberg report.

KKR & Co. (KKR) is planning to invest as much as $1.5 billion in the Reliance’s retail business led by billionaire Mukesh Ambani, according to the report. The news followed Wednesday’s announcement that US-based private equity firm Silver Lake has invested about $1 billion for a 1.5% stake in Reliance Retail Ventures. Silver Lake has already invested $1.35 billion in Reliance Industries’ telecommunications and digital services unit Jio Platforms.

Recently, KKR has agreed to sell its business software company Epicor Software to Clayton Dubilier & Rice for $4.7 billion. John Park, Head of Americas Technology Private Equity at KKR said that “We are confident that CD&R will provide valuable support as the company continues these product- and customer- centric investments to accelerate growth in the cloud.” (See KKR stock analysis on TipRanks).

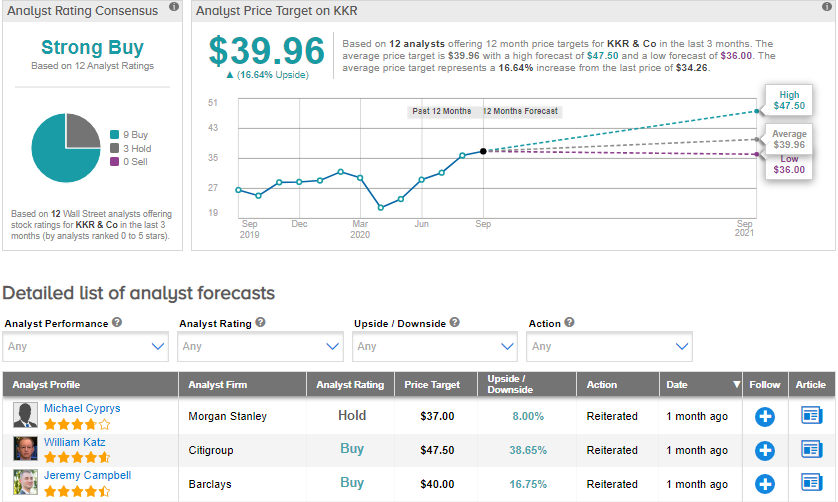

Following KKR’s 2Q results last month, Citigroup analyst William Katz raised the price target on the stock to $47.50 (38.7% upside potential) from $40 and maintained a Buy rating, calling the earnings call “increasingly favorable” around its “flywheel drivers and scaling footprint.” Further, he sees potential upside to current estimates saying the impacts of Global Atlantic, “nascent” retail opportunities and Asia platform expansion “reflect a degree of conservatism”.

Currently, the Street has an optimistic outlook on the stock. The Strong Buy analyst consensus is based on 9 Buys and 3 Holds. The average price target of $39.96 implies upside potential of 16.6% to current levels. Shares have gained over 17% year-to-date.

Related News:

Lyft Rides Reach New High Since April; RBC ‘Patiently Optimistic’

Slack Tanks 19% In After-Hours As 2Q Billings Miss Estimates

Lululemon Skids 6% As 3Q Profit Expected To Drop