KKR & Co. (KKR) is among three buyout funds bidding to acquire Spanish telecom carrier Masmovil Ibercom SA, for 22.5 euros a share or a total of 2.96 billion euros ($3.3 billion).

KKR is joining Cinven Ltd. and Providence Equity Partners in the public offering for all of Masmovil’s shares. The offer is about 20% above Masmovil’s closing share price of 18.72 euros on Friday. Shares in the Spanish telecom operator, which currently has a market value of about 3 billion euros ($3.4 billion), jumped 22% on Monday morning.

If the deal goes through the three funds would each own 33.33% in Spain’s fourth largest telecommunications operator. The operator offers fixed line, mobile, and internet services to residential customers, businesses and operators through a number of brands including Lebara and Yoigo.

The move comes after KKR this month announced that it will inject $1.5 billion in Indian telecommunications company Jio Platforms Ltd., its biggest investment in Asia. The firm has in recent years invested over $30 billion (total enterprise value) in tech companies, and today its technology portfolio has more than 20 companies across the technology, media and telecom sectors.

Shares in KKR have been on a steep recovery path soaring almost 50% since March 23. The stock dropped 1.8% to $27.75 as of Friday’s close.

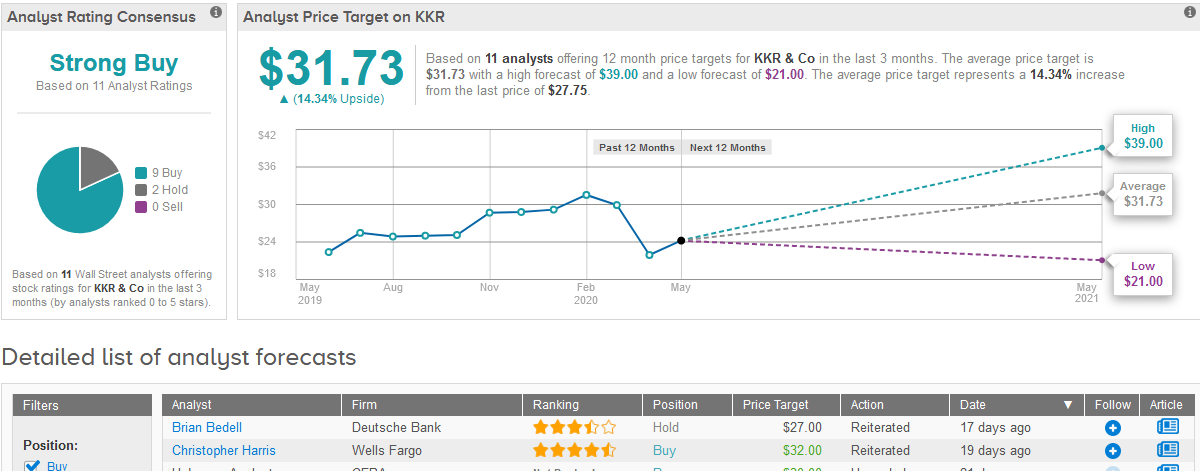

Despite the recent rally, the $31.73 average price target still implies that shares have room to gain another 14% in the coming 12 months. (See KKR stock analysis on TipRanks).

In a bullish note, five-star analyst Chris Kotowski at Oppenheimer maintained a Buy rating on the stock with a $34 price target, saying that the private equity firm is a “very compelling investment at 9.0x enterprise value (ex net cash & investments)”.

“We think there is significant upside to distributable earnings over time as there is ample room for the real asset and public market platforms to grow, balance sheet investment to be monetized and positive outlook regarding base management fee growth on funds associated with the next-generation flagships and other associated strategies,” Kotowski wrote.

Turning now to the rest of Wall Street, analysts have a prevailing bullish outlook on the stock. The Strong Buy consensus boasts 9 Buy ratings, while 2 analysts have a Hold rating.

Related News:

China’s Tencent To Pour $70B Into ‘New Infrastructure’ Including AI

Alibaba Scores Earnings Beat With Revenue Surging 22% Y/Y

Facebook Workplace Hits 5 Million Paid Users As Remote Work Demand Rises