KKR (NYSE:KKR) acquired a portfolio of 18 multifamily assets comprising over 5,200 units from Quarterra. The global investment firm paid $2.1 billion for this deal, aiming to benefit from the recovery in the Housing sector. Quarterra, a subsidiary of Lennar Corporation (NYSE:LEN), is a multifamily real estate development company.

The Multifamily Housing sector has faced several challenges, including stagnant rent and higher interest rates, which have negatively impacted valuations. However, these conditions have created good investment chances for firms like KKR, which are in a strong position to take advantage of market dynamics.

Justin Pattner, partner at KKR and head of real estate equity in the Americas, said that the current market conditions present a solid opportunity to invest in real estate. He noted that transaction activity is starting to pick up after two years. Thus, he seeks opportunities to invest in large pools of high-quality assets.

KKR Eyes the Real Estate Sector

KKR sees a compelling market environment for purchasing quality real estate. In April, the firm acquired a student housing portfolio owned by Blackstone’s (NYSE:BX) Real Estate Income Trust (BREIT) for $1.64 billion, reflecting its long-term conviction in the student housing sector.

Additionally, KKR has been diversifying its portfolio by acquiring a mix of high-quality properties. The firm bought two multi-tenant industrial buildings in the Nashville Airport submarket in May.

Is KKR a Good Stock to Buy?

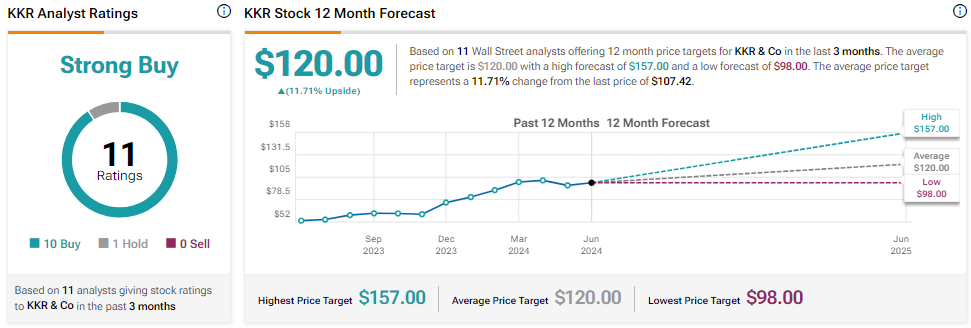

Wall Street analysts are bullish about KKR stock. According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on KKR stock find its valuation attractive. The analysts cite the company’s resilient growth outlook and solid long-term growth potential as catalysts.

KKR stock has more than doubled over the past year. It has 10 Buys and one Hold recommendation for a Strong Buy consensus rating. The analysts’ average KKR stock price target is $120, implying 11.71% upside potential from current levels.