Kiniksa Pharmaceuticals announced that the US Food and Drug Administration (FDA) has approved its ARCALYST injection therapy as a first-of-its-kind treatment for adults and children 12 years and older with recurrent pericarditis and the reduction in risk of recurrence. Shares of the biopharmaceutical company rose 12.5% in Thursday’s extended trading session after closing 3.3% lower on the day.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Kiniksa (KNSA) said that the approval followed clinical trials, which showed that after the first dose of ARCALYST, both reported pain and inflammation reduced rapidly. Notably, positive data from RHAPSODY, a pivotal Phase 3 trial of ARCALYST in recurrent pericarditis, was the supporting factor for the approval.

ARCALYST, a weekly, subcutaneously-injected, recombinant dimeric fusion protein that blocks IL-1α and IL-1β signaling, was discovered by Regeneron Pharmaceuticals (REGN) and licensed by Kiniksa in 2017.

About 40,000 patients in the US are being affected by recurrent pericarditis each year. It is a painful auto-inflammatory cardiovascular disease, which causes chest pain and is often associated with changes in electrical conduction and sometimes buildup of fluid around the heart, called pericardial effusion. Recurrent pericarditis symptoms have an impact on quality of life, limit physical activities, and lead to frequent emergency department visits and hospitalizations, the company said. (See Kiniksa stock analysis on TipRanks)

Kiniksa CEO Sanj K. Patel said, “We look forward to launching ARCALYST for recurrent pericarditis with the support of our experienced commercial and medical affairs teams and, importantly, providing this breakthrough therapy to patients suffering with this debilitating disease as quickly as possible.” The commercial launch of ARCALYST is anticipated to be in April 2021.

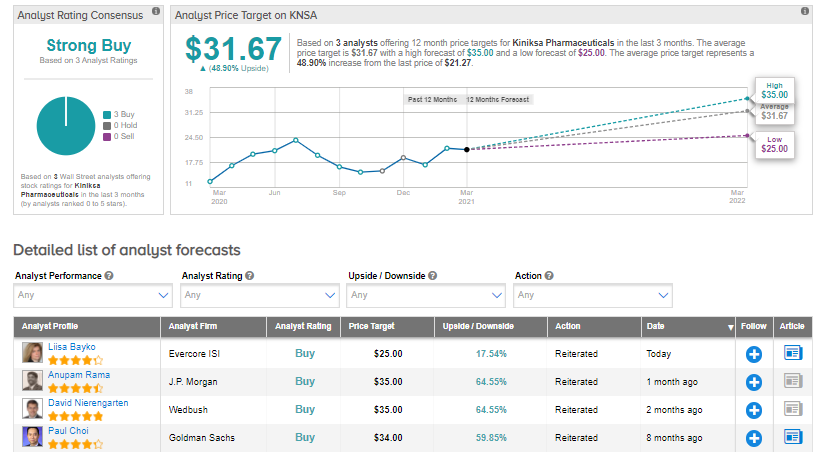

Following the recent development, Evercore ISI analyst Liisa Bayko maintained a Buy rating and a price target of $25 (17.5% upside potential).

Bayko said, “While not a huge surprise, this is a nice win for Kiniksa and their first approved product.”

Kiniksa shares have exploded almost 66% over the past year, while the stock still scores a Strong Buy consensus rating based on 3 unanimous Buys. That’s alongside an average analyst price target of $31.67, which implies 48.9% upside potential to current levels.

Related News:

Lennar’s 1Q Results Top Analysts’ Expectations As Housing Market Picks Up

Johnson & Johnson’s Single-Dose COVID-19 Vaccine Granted Emergency Use Listing By WHO

CDW Inks Deal To Buy Amplified IT; Street Says Buy