Kiniksa Pharmaceuticals (KNSA) recently announced its Q3 results, which exceeded expectations with a 67% revenue upsurge to $112.2 million, outperforming the anticipated $111.5 million. This growth was spearheaded by the heightened demand for Arcalyst, the company’s flagship product, which recorded a remarkable 73% sales increase year-over-year. Alongside promising financials, the company has initiated innovative educational campaigns in collaboration with high-profile figures and continues to advance in ongoing clinical trials, signaling upside future potential. Yet, despite the top-line beat, the stock has dropped over 17%. Investors may want to let the dust settle and then take advantage of the dip in price.

Kiniksa’s Promising Treatment Pipeline

Kiniksa Pharmaceuticals is a biopharmaceutical firm dedicated to discovering and developing therapeutic medicines for patients with severe unmet medical needs. The company’s treatments include ARCALYST for the treatment of recurrent pericarditis; Mavrilimumab, which is currently in Phase II clinical trials for giant cell arteritis; Vixarelimab, in Phase 2b clinical trials for prurigo nodularis; and KPL-404, an inhibitor of the CD40- CD154 interaction crucial for B-cell maturation.

The company continues its focus on promoting early diagnosis and treatment of recurrent pericarditis with the recent launch of its educational campaign, “Life DisRPted.” It has partnered with notable personalities such as NHL Hall-of-Famer Henrik Lundqvist and GRAMMY Award-winning singer-songwriter Carly Pearce to drive this initiative.

Lead treatment ARCALYST, an IL-1α and IL-1β cytokine trap, reported net product revenue of $112.2 million in Q3 2024. Since its launch in April 2021, ARCALYST has been widely received, with over 2,550 prescribers writing prescriptions for recurrent pericarditis.

Kiniksa is progressing with its Phase 2b clinical trial of Abiprubart, an anti-CD40 monoclonal antibody inhibitor.

Kiniksa’s Recent Financial Results

The company recently reported results for Q3 2024. Revenue was $112.21 million, a year-over-year increase from $67 million, beating expectations by $0.61 million. Unlike the previous year, Kiniksa did not record any license and collaboration revenue for Q3 2024. Operating expenses for the third quarter rose to $121.9 million, up from $78 million in 2023. This increase included a rise in collaboration expenses, driven by ARCALYST collaboration profitability, from $17.3 million in 2023 to $29.3 million in 2024. Net loss was slightly down at $12.7 million, compared to a net loss of $13.9 million the previous year. The company reported GAAP earnings per share (EPS) of -$0.18, missing expectations by $0.20.

As of the quarter’s end, Kiniksa reported a balance sheet with $223.8 million in cash, cash equivalents, and short-term investments, carrying no debt.

Management has increased its guidance, anticipating an increase in the 2024 ARCALYST net product revenue. Projections range from $410 million to $420 million, compared to the earlier forecast of $405 million to $415 million. Additionally, the company expects to maintain a positive cash flow annually.

What Is the Price Target for KNSA Stock?

Before the market’s adverse reaction to Q3 earnings, the stock had been trending upward, climbing roughly 52% over the past year. It trades in the upper half of the 52-week price range of $14.12 – $28.15 but shows negative price momentum, as it now trades below the 20-day (25.68) and 50-day (25.25) moving averages.

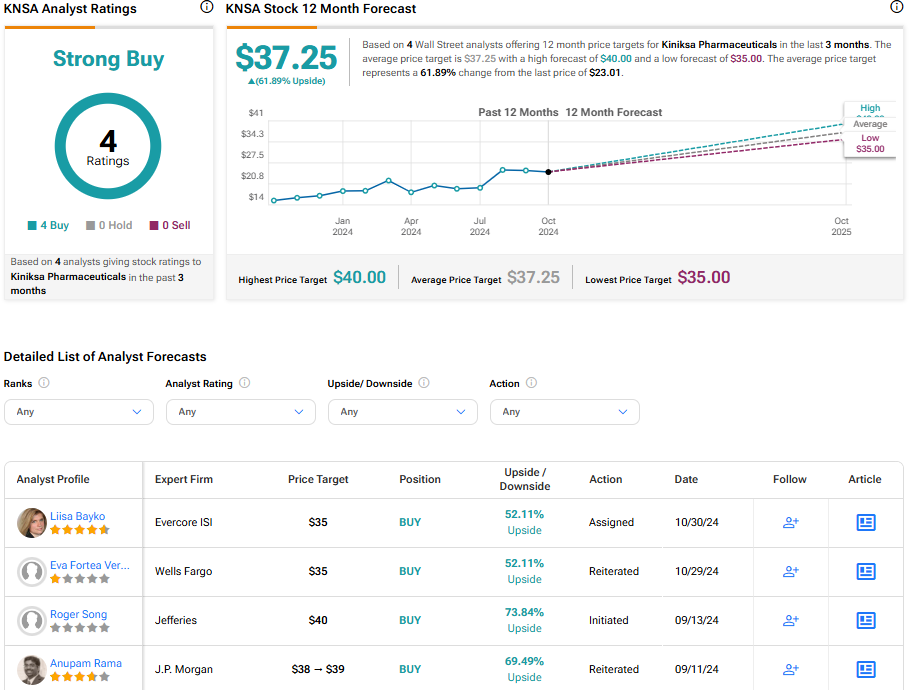

Analysts following the company have been bullish on KNSA stock. For instance, Jefferies recently initiated coverage of Kiniksa with a Buy rating and a $40 price target, noting that the lead drug is performing well after three years of launch and has continued growth momentum to potentially achieve blockbuster status in the coming years.

Based on the recent recommendations of four analysts, Kiniksa Pharmaceuticals is rated a strong buy overall. The average price target for KNSA is $37.25, representing a potential upside of 61.89% from current levels.

Final Analysis of Kiniksa

Kiniksa Pharmaceuticals continues to gain ground with a notable revenue increase fueled by the success of ARCALYST. Further, with a pipeline of therapies in various phases of clinical trials, the company shows potential ongoing upside. Ultimately, the company’s upward revision of ARCALYST’s net product revenue guidance, combined with a favorable forecast from analysts, signals promising prospects for investors willing to see past market fluctuations.