Shares of Kingsoft Cloud Holdings Limited (KC) jumped 6% on Wednesday after the independent cloud service provider in China reported robust second-quarter revenues. Strong momentum in the public and enterprise cloud services segments aided the top line.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Markedly, revenues jumped 41.6% year-over-year to $336.7 million. The increase in revenues reflected a surge in public cloud services revenues despite market headwinds, which increased 20.5% to $240.2 million.

Furthermore, enterprise cloud service revenues increased 152.8% year-over-year to $96.4 million. The growth was driven by the strong execution and implementation of benchmark projects in certain industries. (See Kingsoft Cloud Holdings stock charts on TipRanks)

However, the company reported a net loss of RMB0.07 ($0.01) per share versus a loss of RMB0.19 per share reported in the prior-year period.

Based on strong Q2 revenue growth, the company provided guidance for the third quarter of 2021. The company forecasts revenues to grow 49% to 56% year-over-year to between RMB2.58 billion and RMB2.7 billion.

Kingsoft Cloud CEO Mr. Yulin Wang said, “We also look forward to the onboarding of the core management team from Camelot in relation to the recently announced strategic move in enterprise cloud services, where synergies in premium customer base, product offering portfolio, and project implementation capabilities are to be expected.”

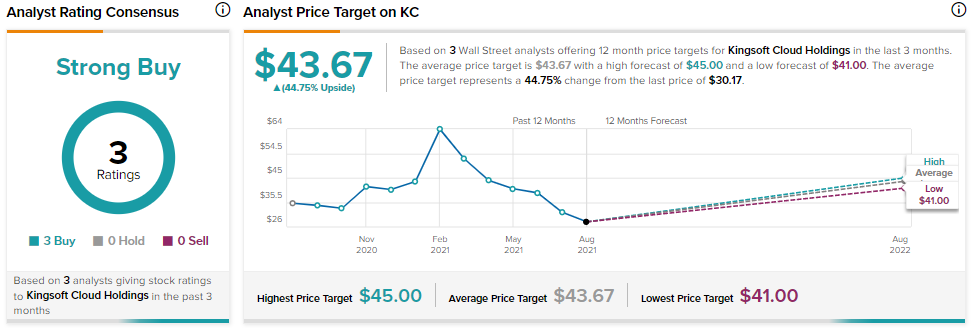

Goldman Sachs analyst Piyush Mubayi recently decreased the price target from $57 to $41 (35.9% upside potential) while reiterating a Buy rating on the stock.

Overall, the stock has a Strong Buy consensus rating based on 3 unanimous Buys. The average Kingsoft Cloud Holdings price target of $43.67 implies 44.8% upside potential from current levels.

Related News:

Advance Auto Parts Posts Q2 Earnings Beat, Raises Guidance

Pinduoduo Reports Strong Q2 Results & RMB10 Billion Agri-Initiative; Shares Surge 22%

Xponential Fitness Reports First Loss since IPO, Shares Down 3.1%