Real estate investor Kennedy Wilson Holdings (KW) and its equity partner have acquired an office campus in London, The Capitol Building, for a consideration of $66.2 million, implying a capitalization rate of 7.7%. The partnership has invested $29 million of equity, with Kennedy Wilson owning a 51% interest.

Mike Pegler, Head of UK, Kennedy Wilson, said, “This attractive acquisition just outside Greater London is the second acquisition with our joint venture partner of a prime suburban office campus, offering a high-income yield from a quality, well-let asset in a local submarket that we know very well.” (See Kennedy Wilson stock chart on TipRanks)

Pegler added, “The Thames valley thrives on the tech and life sciences sectors, which are very well represented at The Capitol Building, and are contributing to the increasing demand we are seeing for low-rise and suburban office campus.”

At present, The Capitol Building has 97% occupancy by 9 tenants belonging to the tech and business service industries.

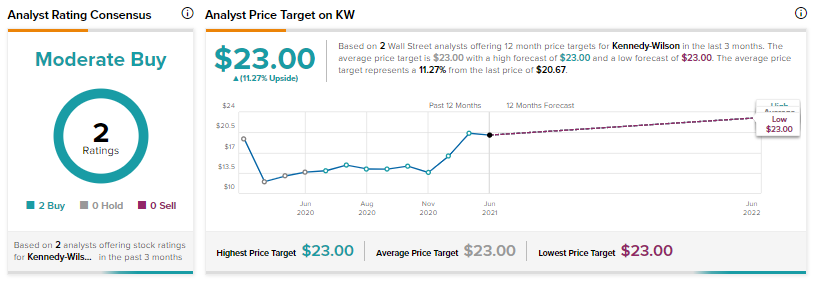

Recently, Evercore ISI analyst Sheila McGrath reiterated a Buy rating on the stock with a price target of $23 (11.3% upside potential). McGrath views Kennedy Wilson “as an attractive small-cap value play that is poised to benefit from the reopening of the economy.”

The other analyst covering the stock, J.P.Morgan’s Anthony Paolone also has a buy rating on Kenndy Wilson with the same target price as McGrath.

The two ratings add up to a Moderate Buy consensus rating. The average Kennedy Wilson analyst price target of $23 implies 11.3% upside potential. Shares have gained 38.1% over the past year.

Related News:

High Tide Acquires Daily High Club

Synopsis Announces $175M Share Repurchase Program, Collaboration with Samsung

Vertex Pharmaceuticals Announces $1.5B Stock Repurchase Program