Fintech company SoFi Technologies (NASDAQ:SOFI) slid in pre-market trading on Wednesday after top-rated Keefe Bruyette analyst Michael Perito downgraded the stock from Hold to Sell and lowered the price target to $6.50 from $7.50. The analyst’s price target implies a downside potential of 32.6% at current levels.

Perito cited a combination of the stock’s recent outperformance and re-underwriting of the company’s business model. SOFI stock has surged by more than 100% over the past year. In addition, the analyst’s revised 2024 revenue and EBITDA estimates are 10% and 17% below consensus, driven by slower origination growth and revenues from technology.

Is SOFI Stock a Buy?

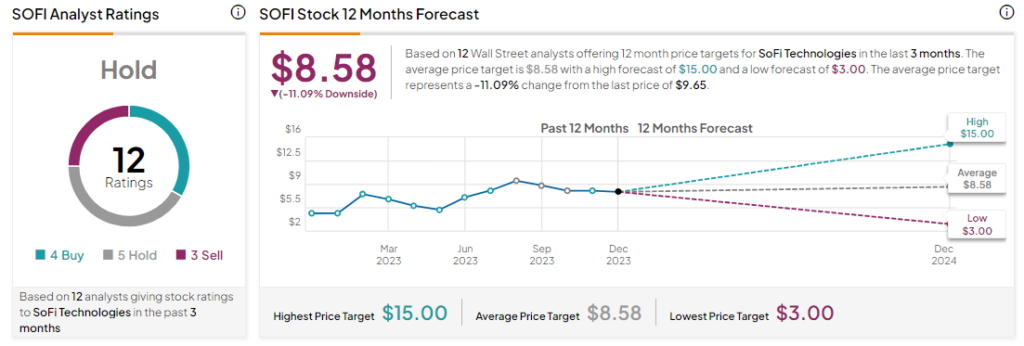

Analysts remain sidelined about SOFI stock with a Hold consensus rating based on four Buys, five Holds, and three Sells. The average SOFI price target of $8.58 implies a downside potential of 11.1% at current levels.