Keurig Dr Pepper, Inc. (KDP) authorized a share repurchase program of up to $4 billion of its outstanding common shares at its Investor Day held on October 1.

Shares of the U.S.-based beverage conglomerate with headquarters in Burlington, Massachusetts, have gained 20% over the past year. (See Keurig Dr Pepper stock charts on TipRanks)

The buyback represents 8% of the company’s outstanding share capital based on KDP’s share price as of September 29, 2021.

The buyback program is effective for four years, from January 1, 2022, until December 31, 2025. The buybacks timing, pricing, and transaction amounts will be subject to certain regulatory requirements, the discretion of KDP, and market conditions.

Additionally, the company also reiterated its outlook for 2021. It forecasts net sales growth in the range of 6% to 7%, while adjusted diluted EPS is expected to grow in the range of 13% to 15%.

Following the Investor Day, UBS analyst Sean King reiterated a Buy rating with a price target of $41 (23.5% upside potential) on the stock.

King commented, “We acknowledge investor concerns over the preliminary FY22 EPS guide of +MSD but we see this as prudent in the current inflationary environment impacting all of CPG.”

The analyst further added, “We expect KDP to deliver at or above +MSD EPS growth in FY22 on the back of share repurchases. We also argue that KDP’s unique operating model should prove more insulated than peers from these pressures.”

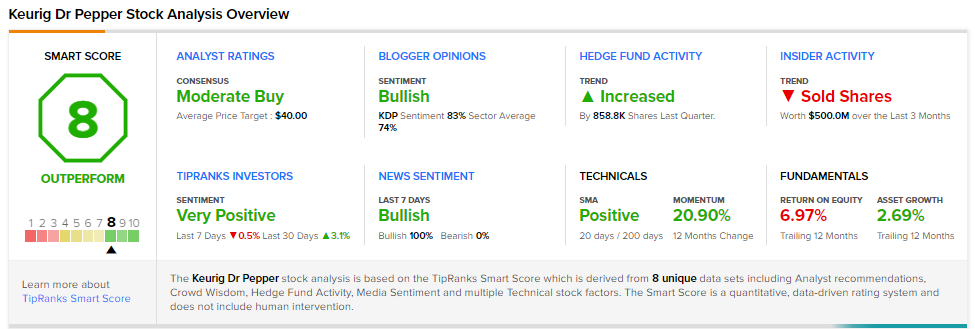

Consensus among analysts is a Moderate Buy based on 4 Buys and 2 Holds. The average Keurig Dr Pepper price target of $40 implies 20.5% upside potential to current levels.

KDP scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Jabil Posts Mixed Q4 Results; Shares Fall 6.1%

Uber Partners with UATP on Uber Wallet Integration

ArcBest to Snap Up MoLo Solutions for $235M