Karyopharm Therapeutics, Inc. (KPTI) has reported better-than-expected fourth-quarter results, as both earnings and revenues surpassed expectations. The pharmaceutical company engages in the discovery, development, and commercialization of novel first-in-class drugs directed against nuclear export and related targets for the treatment of cancer.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Shares of the company declined 20% on Tuesday and a further 1.6% in the extended trading session. However, the stock gained 2% at the time of writing.

Karyopharm reported adjusted earnings of $0.46 per share against the Street’s estimate of a loss of $0.49 per share. Also, the figure increased significantly from a loss of $0.59 per share a year ago. Total revenues amounted to $126.3 million, significantly higher than $35.1 million reported in the fourth quarter of 2020 and analysts’ expectations of $50.5 million.

Product revenue of $29.8 million increased 47.4% year-over-year. Moreover, the company reported license and other revenue of $96.5 million, up significantly from $14.9 million in the fourth quarter of 2020.

R&D expenses during the quarter came in at $44 million, up 18.3% from same quarter last year. Also, selling, general and administrative expenses stood at $34.6 million, compared to $33.9 million in the fourth quarter of 2020.

The President and CEO of Karyopharm, Richard Paulson, said, “We delivered consecutive quarters of double-digit growth driven by XPOVIO’s strong commercial performance in the second half of the year and head into 2022 with momentum as we continue to prioritize driving sales and the adoption of XPOVIO in multiple myeloma… We are also progressing our pipeline in key indications of multiple myeloma, myelodysplastic syndromes and myelofibrosis to improve survival and outcomes for patients with cancer.”

Outlook

The company projects XPOVIO net product revenue to be in the range of $135 million to $145 million. Also, adjusted R&D and SG&A expenses, excluding stock-based compensation expense, for 2022 is anticipated to be in the range of $265 million to $280 million.

Stock Rating

Following the news, J.P. Morgan analyst Eric Joseph upgraded Karyopharm’s rating to Hold from Sell. The analyst has set a price target of $8, which indicates 2.3% downside potential from current levels.

Joseph noted, “With Xpovio sales counting to grow albeit at a modest pace, we see a stabilizing sentiment for Karyopharm’s commercial outlook in the near to mid-term. That said, we remain cautious on Xpovio’s growth potential in the earlier-line myeloma setting with lingering concerns over the real-world tolerability and therapy duration limitations.”

Based on 1 Buy and 5 Holds, the stock has a Hold consensus rating. The average Karyopharm price target of $8.80 implies 7.5% upside potential from current levels. Shares have declined 49% over the past year.

Negative Sentiment

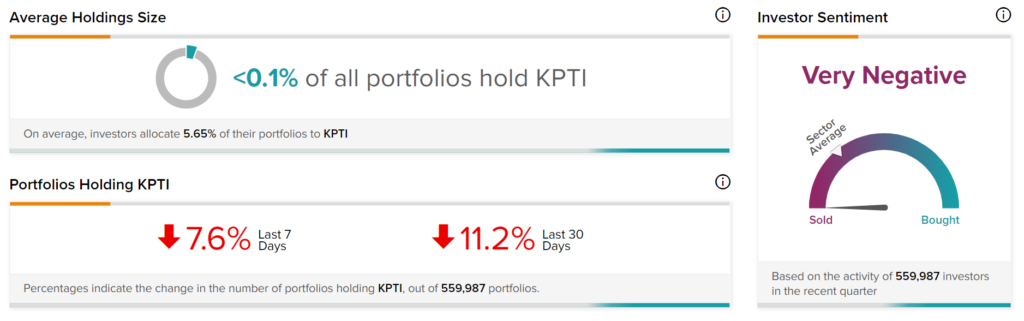

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Karyopharm, as 11.2% of investors decreased their exposure to KPTI stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Coty Pops 8% on Q2 Earnings Beat, Raises EPS Guidance

GM to Boost Production of Cadillac SUV, Electric Trucks — Report

Sysco Delivers Mixed Q2 Results Hurt By High Operating Expenses