Market investors are always on the lookout for one thing: a clear sign that a particular stock presents a solid opportunity to buy in now for a profitable return. One of the clearest signs is the stock split, a corporate action taken when share prices are judged high. Splits increase the number of shares outstanding, reduce the share price, and make it easier for investors to buy in. In short, the split is a good way to increase liquidity by drawing in new shareholders.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

From the investor’s perspective, stock splits are generally taken as a positive sign for a stock’s near-term performance, and the statistics back that up. An analysis by Stocksoft Research shows that post-split shares outperform the S&P 500 index by a 2-point margin in the first six months after the split action. A dive into the split data by Bank of America agreed that split stocks have a strong probability of outperforming the S&P 500. Looking at 40-year data for the first 12 months following a stock split, the average post-split return comes to 25.4%, doubling the average return seen on the broader S&P index for those months.

Wall Street’s top analysts are aware of this, and some of them are pointing investors toward shares that have recently split. We’ve used the TipRanks database to look up the broader view on two of these choices. Here are the details.

Amphenol (APH)

The first stock on our list here is Amphenol, a high-tech company focused on the development, production, and distribution of interconnect, sensor, and antenna solutions. The company’s product list includes raw cable, cable assemblies and connectors, integrated circuits, power distribution nodes, and antenna solutions, to list just a few. Amphenol serves industrial and tech customers across a wide range of fields, including automotive, broadband and data communications, aerospace, defense, IT, and mobile networks. The Connecticut-based firm is one of the world’s largest providers of these essential tech devices and accessories.

A few numbers will show Amphenol’s scale and imply the importance of its product lines. The company operates facilities in 40 countries, employing approximately 95,000 people, and in 2023 it brought in nearly $12.6 billion in total sales revenues. Amphenol has a market cap of $76 billion and is one of the many tech firms that do not have a household name but still offer sound incentives for investors.

In its last four reported quarters, Amphenol has reported quarterly earnings consistently above $3 billion. That last quarter, 2Q24, saw the firm bring in $3.61 billion, for an 18% year-over-year gain – and beating the forecast by $230 million. At the bottom line, Amphenol reported 44 cents per share in non-GAAP earnings, beating the forecast by 3 cents per share and growing 22% year-over-year. Taking some recent losses into account, shares in APH are up 47% in the last 12 months.

With the company running strong revenues and realizing solid share performance, management chose to execute a 2-for-1 stock split. The split was announced on May 20 and executed on June 12. At the time of the split, the shares were trading between $135 and $140 each, and the split brought the price down below $70.

For J.P. Morgan analyst Samik Chatterjee, a 5-star analyst rated in the top 4% of the Street’s stock pros, the key point here is the company’s continued success generating sales.

“Despite the likely disappointing lofty expectations heading into the print, we do not see any change in fundamentals for the company with a majority of its end-markets outperforming its outlook, including in particular IT Datacom, led by strong AI demand momentum, which led to another quarter of strong order growth – expanding to $4.1 bn (+21% q/q and +33% y/y) supporting a robust book-to-bill of 1.13x. Additionally, management noted order improvement in areas, like Industrial, where organic revenue has seen multiple quarters of year-over-year declines,” Chatterjee opined.

The 5-star analyst goes on to explain why this is a solid choice for investors, saying, “Thus, we see the continuation of improved order trends as corroborating our expectations for a positive setup in 2H24 and into 2025 with strong secular tailwinds associated with AI infrastructure deployments being aided by cyclical recovery in traditional end-markets as well as M&A.”

Quantifying his stance, Chatterjee rates APH as Overweight (i.e. Buy), and he gives the stock an $80 price target that implies a one-year upside potential of 25%. (To watch Chatterjee’s track record, click here)

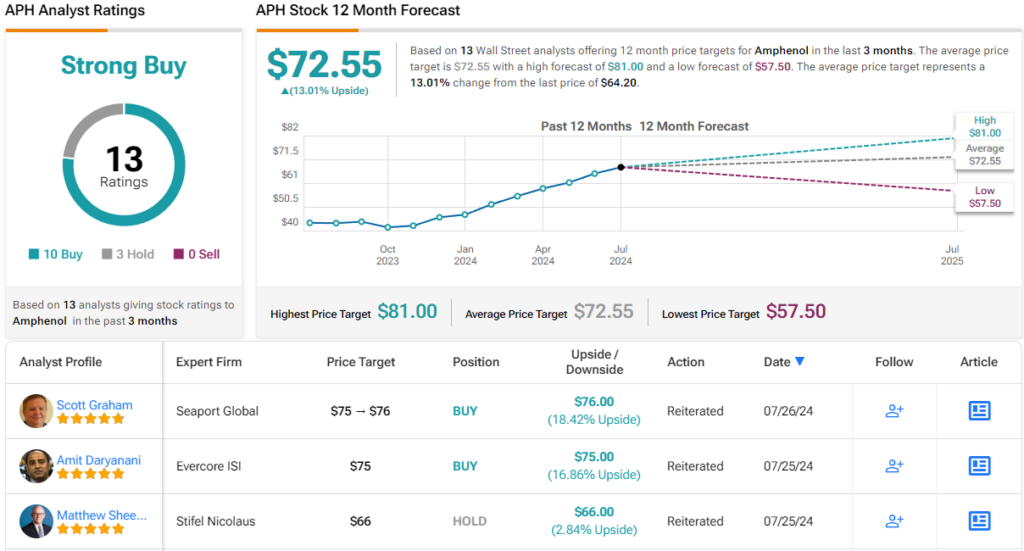

Overall, APH has a Strong Buy consensus rating, based on 13 analyst reviews that include 10 Buys and 3 Holds. The stock’s $64.10 share price and $72.55 average target price together suggest a 13% is in the offing for the coming year. (See APH stock forecast)

W.R. Berkley Corporation (WRB)

From tech, we’ll switch to insurance. W.R. Berkley is an insurance holding company, in operation since 1967, and working in a wide range of insurance segments. The company offers commercial lines of property & casualty insurance on the global scene and is active in the US, the UK, Continental Europe, Canada and Mexico, South America, and Asia and Australia. The company offers specialized expertise across 60-plus insurance lines, and its decentralized structure allows its subsidiaries to build strong relationships with local customers based on local conditions, while reacting quickly to changes in the markets.

For the customers, Berkley is a stable provider of insurance products, capable of covering most any contingency. The company offers coverage for accident & health, commercial auto & trucking, crime & fidelity, farm owners insurance, equine & cattle, product liability, professional liability, medical liability, workers compensation – it’s a long list, and Berkley has built a reputation as a solid player in the industry. The company boasts a market cap above $20 billion, giving it the deep pockets needed to back up a large-scale insurance business.

In its last reported earnings, covering 2Q24, Berkley reported $3.13 billion in net premiums written, a key metric for an insurer. This represented more than 11% year-over-year growth and beat the forecast by $290 million. The company realized a non-GAAP EPS of $1.04 based on those premiums, 12 cents per share better than had been expected. Berkley’s return on equity in the quarter came to 20%.

These results were reported on July 22 and reflected a stock split executed on July 10. The split was set at 3-for-2, giving each shareholder 3 shares for each existing 2 shares – the company increased its shares outstanding by 50%. Post-split, the stock was trading for approximately $53.

This insurer caught the eye of analyst Mark Hughes, from Truist Financial. Hughes, who holds a 5-star rating from TipRanks and is placed among the top 20 analysts on Wall Street, says of Berkley in a post-split note, “We are raising our 2024 EPS estimate to $4.08 from $3.82 based on increased optimism regarding investment income and topline growth, while we are likewise boosting our 2025 forecast to $4.30 from $4.16 per share. Our target of $64 (from $62) assumes the stock appreciates with bottom-line gains and that the P/E multiple improves to 15x next year’s earnings, in line with the specialty P&C current-year average albeit still below the company’s own multi-year norm.”

The $64 price target noted above suggests a one-year gain of ~19%, supporting the analyst’s Buy rating on the shares. (To watch Hughes’ track record, click here)

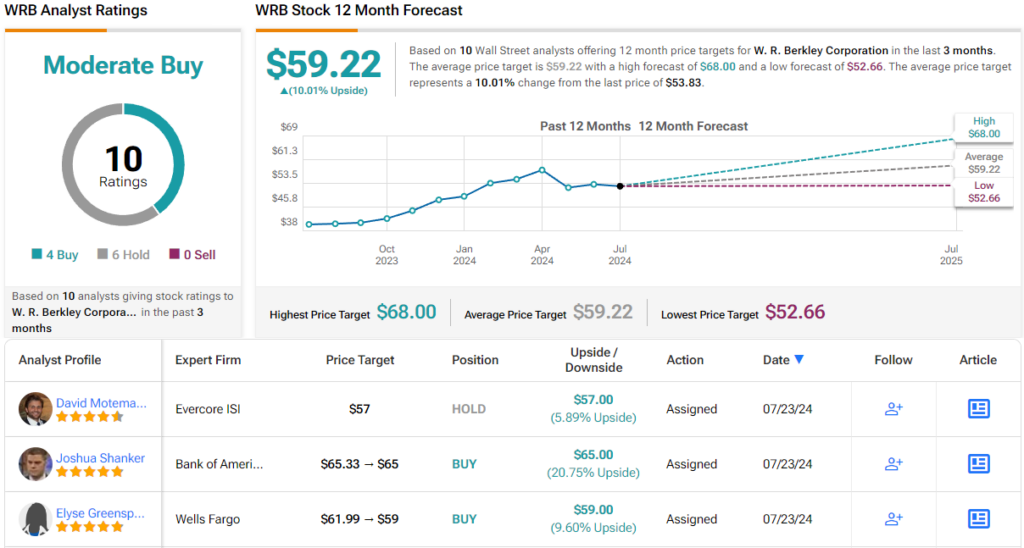

Overall, Berkley’s stock has a Moderate Buy consensus rating from the Street’s analysts, based on 10 reviews with a breakdown of 4 Buys and 6 Holds. The stock is selling for $53.83 and its $59.22 average price target implies an upside of 10% in the coming months. (See WRB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.