JPMorgan Chase & Co. (JPM) has delivered better-than-expected Q3 results, driven by top-line growth that was aided by robust M&A activity and the strong performance of the company’s wealth management unit. The investment banking and financial services giant also reported credit reserves release of $2.1 billion.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Earnings jumped 28.1% year-over-year to $3.74 per share, beating the Street’s estimates of $3 per share. Revenues rose 2% to $30.4 billion, ahead of analysts’ expectations of $29.8 billion. (See JPMorgan stock chart on TipRanks)

The company’s non-interest income grew 3% on the back of a rise in investment banking fees (up 45% on higher advisory and equity underwriting fees) and assets management fees.

Meanwhile, net interest income rose 1% because of balance sheet growth and higher rates. The provision for credit losses was a net benefit of $1.5 billion in the quarter, driven by improvements in the economic outlook.

The Chairman and CEO of JPMorgan, Jamie Dimon, said, “We are making important investments, including strategic, add-on acquisitions that will drive our firm’s future prospects and position it to grow and prosper for decades… We are more than halfway through our plan to open 400 branches in new markets by the end of 2022, with approximately 30% of these branches in low to-moderate income communities. We are also expanding our retail presence internationally, most recently launching our digital retail bank in the U.K.”

Prior to the earnings release, Jefferies analyst Ken Usdin maintained a Buy rating on JPMorgan and raised the price target to $198 from $177. The new price target implies 19.7% upside potential.

Usdin is of the opinion that JPM’s diversified business model will continue to outperform peers in each segment.

See Analysts’ Top Stocks on TipRanks >>

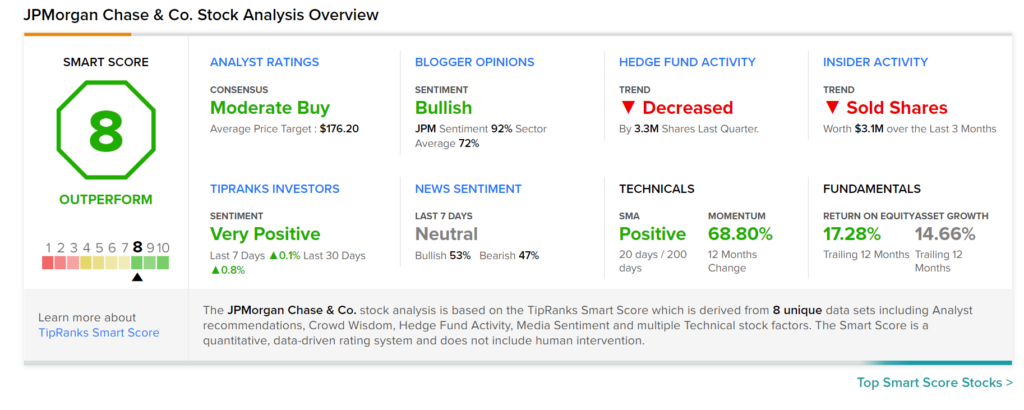

Overall, the stock has a Moderate Buy consensus based on 7 Buys, 2 Holds and 1 Sell. The average JPMorgan price target of $176.20 implies 6.6% upside potential.

JPM scores an 8 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

Related News:

Qualcomm Increases Share Buyback Plan by $10B

LG Electronics to Reimburse GM for Bolt EV Recall — Report

Smart Global Shares Gain 6% on Solid Q4 Results